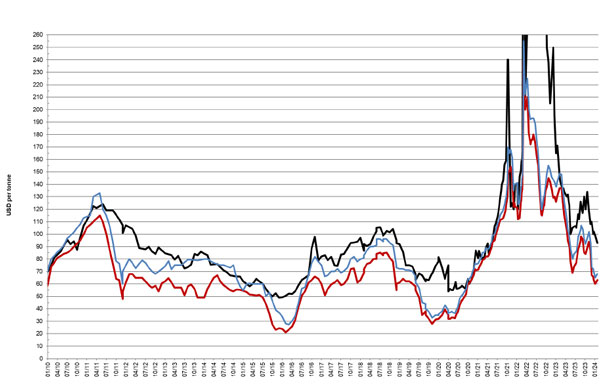

Coal fell sharply below US$100, due to weak demand and large stocks, on 22 January 2024, while oil hovered around the US$80/bbl mark as freight issues in the Suez Canal and the Red Sea supported oil prices.

Petcoke FOB contracts recovered from December lows as demand forecast for 1Q24 and 2Q24 shows an upward trend and discounts were increasing until weaker coal prices emerged. Discounts on FOB contracts declined and ARA discounts returned to neutral from an earlier spell in the cheap zone.

FOB discounts narrowed after coal prices weakened

Petcoke with 6.5 per cent S is expected to continue in the US$58-68 range with resistance at US$68, US$80, US$95, US$105, US$115 and US$135. Support is at US$60, US$55 and US$45 with multi-year support at US$37. For 2024 a broad range of US$70-115 is expected.

The discount for 6.5 per cent S petcoke FOB sold at US$63 is at 46 per cent when compared with API4 coal sold at US$88 in the 2Q24. The CIF ARA 6.5 per cent S petcoke contract sold at US$86 is at a discount of 22 per cent, when compared with API2 coal sold at US$93 in the 2Q24.

Freight rates are increasing with the USGC-ARA rate at US$23.