By Frank O. Brannvoll, Brannvoll ApS, Denmark

Inflation is still playing a crucial role, as it remains stubborn and both the US Federal Reserve and the European Central Bank are warning the markets that rates will not be cut in the speed expected last year until the two per cent targets are visible. This in combination with lower Chinese activity has rewoken the demand fear and threatened to send oil and other energy commodities lower.

However, geopolitical tensions and renewed sanctions on Russia have sent the oil and coal markets higher while a possible return of Trump and his NATO remarks added to the nervousness.

The euro-US dollar exchange rate has seen an appreciation towards 1.09 but still remains in the range of US$1.06-1.10. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Prices at a glance - 7 March 2024 |

||

|

Crude oil (US$/bbl) |

83.00 |

|

|

Coal |

API2 – 2Q24 (US$) |

110.00 |

|

API2 – Cal 2025 (US$) |

109.00 |

|

|

API4 – 2Q24 (US$) |

107.00 |

|

|

API4 – Cal 2025 (US$) |

111.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

72.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

93.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

68.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

89.00 |

Oil

OPEC+ has extended its output cuts to the end of the 2Q24 with 2.2 mb/d and Saudi Arabia announced it prolongs its 1mb/d cut. However, Russian production cuts of 0.5mb/d surprised the market as US sanctions affecting Russian vessels impacted the capacity of oil transport. The situation with the Houthi attacks on vessels in the Red Sea continues to add uncertainty and a premium to the oil price, which seems stuck in the US$80-85 range. Current US oil producers appear to take advantage of higher WTI oil prices, which keeps a lid on any major price surge.

Short-term forecasts range between US$78-85 with spikes to the topside as risk. Brannvoll ApS lowers forecasts to a trading range of US$70-100, with an average of US$90 for 2024.

Coal

The coal market saw a severe test of major support levels, pressured by lower global gas prices and ample supply.

However, sanctions against Russia’s SUEK removed a significant part of exports, and lower stocks in EU and China put a support under the prices.

Furthermore, financial speculators were active in buying in relatively large volumes, adding further pressure upwards.

New demand in China after the New Year as well as demand from Asia spilled over to Indonesian coal in terms of both API2 and API4 product during the first weeks of March.

Meanwhile, Russia has revoked its export fee, which depended on the US$/RUB exchange rate for coal and this has now added pressure to the prices again.

The API2 front-quarter (FQ) contract rose by 20 per cent MoM to US$110, lifting the short-term range to US$100-120. The price is breaking the four-month downtrend channel. The API2 Cal25 contract also rose by 12 per cent to US109. Brannvoll ApS forecasts a range of US$100-130 and average of US$125 for Cal25.

The API4 FQ contract rose 15 per cent MoM to US$107, lifting the short-term range back to US$100-120. Meanwhile, the API4 Cal25 contract was 13 per cent higher at US$111. Brannvoll ApS expects a range US$100-150 in 2024 as volatility is higher in API4.

Petcoke

Petcoke has been falling lately, driven by gas and coal prices as well as massive selling by Venezuela. The Chinese New Year and high Indian stocks forced the prices lower as buyers stepped aside. Turkish cement makers were active and January saw the highest import of petcoke in years, particularly driven by Venezuelan imports.

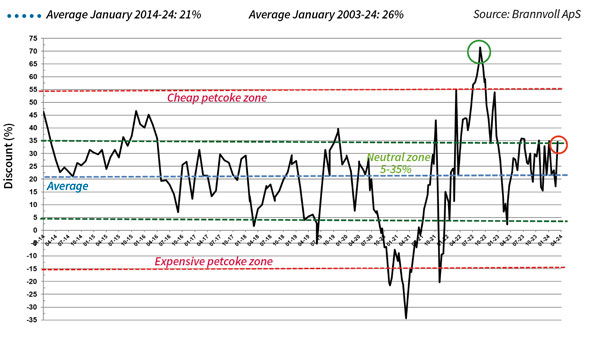

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Mar 2024: 35%

Venezuela is seen active as the period during which the US lifted its sanctions on Venezuelan exports potentially ends on 18 April. This may lead some buyers to abstain from new contracts up to the decision.

However, lower freight rates plus the higher coal and gas prices may put a hold on the slide in prices, and some buyers may bargain hunt in the mid-to-high US$60s for 6.5 per cent FOB price, as the discounts have now again made petcoke cheap.

The USGC FOB 6.5 per cent sulphur (S) contract rose one per cent MoM to US$68, while the discount to API4 rose to 48 per cent. The USGC ARA 6.5 per cent S contract rose one per cent MoM to US$89, but the discount increased to 32 per cent, due to higher ARA coal prices.

The USGC FOB 4.5 per cent S contract slipped one per cent MoM at US$72, with the discount to API4 rising to 45 per cent. The CFR ARA 4.5 per cent contract declined by one per cent MoM to US$93, with the discount increasing to 32 per cent. Based on the discount the levels appear attractive.