Geopolitical news is dictating the markets, with ongoing Ukraine peace talks between the USA, Russia and Europe impacting sentiment, in addition to President Trump’s hot-and-cold stance on trade tariffs, all leading to a wait-and-see attitude in the markets. The German election in February looks set to deliver a broad CDU/CSU+SPD government, aiming at dragging Germany out of recession.

In addition, the massive plans for rearming Europe as the US rolls back its military support has seen a sharp increase in the long-term euro interest rate, despite ECB cutting the short-term rates to 2.50 per cent. This has supported the euro, which has risen against the US dollar.

The CRB commodity index has again dropped sharply with prospects of an end to the Ukrainian war and lower energy prices. The US Federal Reserve kept its interest rate unchanged, as it monitors the impact of the first month of the new administration.

The US dollar has fallen both on broad US$ index and the euro, moving sharply up from major support US$1.04 to US$1.0850, expecting a range of US$1.05-1.10. In 2025 Brannvoll ApS expects a range of US$1.05-1.15, with an average of US$1.12.

| PRICES AT A GLANCE – 6 March 2025 | ||

| Brent crude (bbl) | US$70.00 | |

| Coal API2 | 2Q25 | US$96.00 |

| Cal 2025 | US$103.00 | |

| Coal API4 | 2Q25 | US$92.00 |

| Cal 2025 | US$99.00 | |

| Petcoke USGC 4.5 per cent 40HGI | FOB | US$84.00 |

| CFR ARA | US$103.00 | |

| Petcoke USGC 6.5 per cent 40HGI | FOB | US$90.00 |

| CFR ARA | US$109.00 | |

Oil

The energy complex fell as the oil price dropped, driven by fear of lower demand due to US trade tariffs.

US oil production is increasing and OPEC+ is determined to hike output from April to reverse the cuts from the last year. However, with oil testing the US$70 mark, OPEC+ may be forced at its April meeting to postpone production increases to defend the price at a range of of US$70-90/bbl.

If a lasting peace deal for Ukraine is achieved, allowing US and perhaps EU sanctions to be lifted, Russian oil may enter the market. Despite low gas storage levels in EU countries, the TTF price has fallen by 20 per cent due to lower industrial demand. LNG imports from the USA have increased and those from Russia have persisted.

Brent oil traded six per cent lower at US$70.00, moving to a lower range of US$68-75. Brannvoll ApS forecasts a trading range of US$65-90 and an average of US$75 for 2025.

Coal

Along with reduced oil prices and based on an abundant supply, the coal market moved lower. Chinese domestic prices were falling while in India, output is up. As a result, Newcastle coal fell below US$100, taking API2 below US$100. Several Russian producers are selling at discounted prices that hardly achieve the production cost. Meanwhile, port inventories are relatively high, dampening demand. While there was no major coal news during February, lower gas prices have pressured coal for power generation.

The API2 2Q25/front-quarter (FQ) contract fell by nine per cent MoM to US$96, within the short-term range of US$95-105. The Cal26 contract declined six per cent to US$103. Brannvoll forecasts a range of US$100-130 and an average of US$125 for the FQ contract.

The API4 FQ contract was down nine per cent to US$92, temporarily in a low range of US$90-105. The Cal26 contract fell 10 per cent to US$99. Brannvoll ApS maintains the forecast range of US$100-130 in 2025.

Petcoke

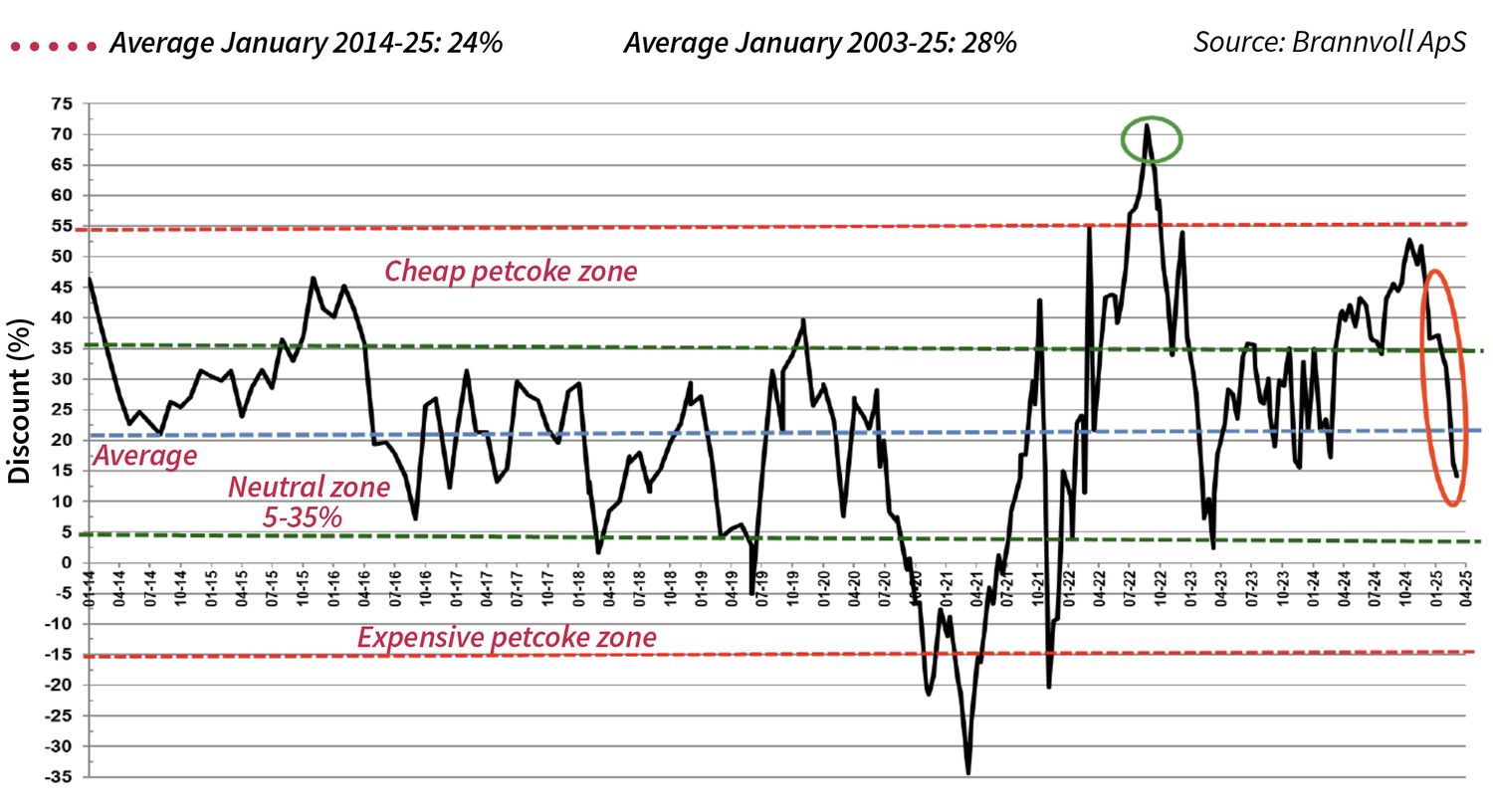

The petcoke market went against the trend, rising slightly due to increased demand from India and China, and in spite of lower output from the USG. Relatively low freight rates supported the spot prices, and increased cement demand in India also increased bid levels. However, the fall in coal prices has now pushed both FOB and ARA discounts so low that petcoke is very expensive.

The competition from falling or discounted Russian coal is seeing buyers’ turn towards coal.

Normally under these conditions, petcoke price can turn sharply downwards if buyers turn to coal, because refiners need to see the flow of petcoke.

In several countries petcoke is currently on a par with coal with the switch expected to increase over the coming months unless petcoke prices fall or coal starts to recover.

The USGC FOB 4.5 per cent sulphur (S) contract was up by eight per cent MoM to US$84 and the discount to API4 fell from 38 to 27 per cent. The USGC ARA 4.5 per cent S contract rose eight per cent MoM to US$103 MoM with the discount falling from 28 to an extremely low level of 14 per cent.

The USGC FOB 6.5 per cent S contract rose by eight per cent MoM to US$90, with the FOB discount to API4 falling to 25 per cent. The CFR ARA 6.5 per cent contract rose nine per cent to US$109, discount dropping sharply to nine per cent.

by Frank O. Brannvoll, Brannvoll ApS, Denmark