By Frank O. Brannvoll, Brannvoll ApS, Denmark

Geopolitics once again dominated the energy complex. Fear of the Gaza conflict spreading towards Lebanon and Iran added a risk premium to oil, driving it above US$90. The US Federal Reserve and the European Central Bank have both claimed that interest rates will not come down before inflation clearly shows movement towards the two per cent benchmark. In combination with high employment and GDP figures, this has lowered prospects for lower interest rates.

In addition, the war in Ukraine has spread to bombing of Russian oil refineries, further adding pressure to the oil price.

The Turkish central bank increased its rate to 50 per cent to stabilise the US dollar-lira exchange rate, which is currently at TRY32. Meanwhile, the euro-US dollar exchange rate is very steady in the range of US$1.06-1.10. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance – 5 April 2024 |

||

|

Crude oil (US$/bbl) |

91.00 |

|

|

Coal |

API2 – 2Q24 (US$) |

116.50 |

|

API2 – Cal 2025 (US$) |

116.00 |

|

|

API4 – 2Q24 (US$) |

106.50 |

|

|

API4 – Cal 2025 (US$) |

114.50 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

72.50 |

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

92.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

68.50 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

88.00 |

|

Oil

In April OPEC+ voted to extend its output cuts to the end of the 2Q24 and will likely keep this throughout 2024. With several international institutions revising up the oil demand the market will face a deficit as long as OPEC+ keeps its cuts.

There is no real change in the Red Sea situation but fewer attacks from Houthi rebels have been seen, along with increased protection from western navy forces.

Venezuela may see reimposed sanctions, which could take away Venezuelan exports from April or after the election has been held on 28 July.

As a result of the US$85 break, the short- term forecast range has been raised to US$85-95. Brannvoll ApS forecasts a trading range of US$70-100, with an average of US$90 for 2024.

Coal

The coal market continued its rally at a slower pace, supported by the oil and gas prices.

The Baltimore bridge accident sent a brief spike through the market, but redirection solved the problem quickly. Meanwhile, good demand is seen from India. Sanctions on SUEK’s exports have also added pressure while Russia’s reintroduction of export fees have added to the price. Colombia was seen actively gaining market share on behalf of Russia in several markets gaining market shares in Turkey. In China the domestic prices have fallen on lower demand and high stocks, while in Europe the ARA stock is being used instead of importing.

The API2 front-quarter (FQ) contract rose by six per cent MoM to US$116, lifting the short-term range to US$105-120 and the downtrend is clearly broken. For the Cal25 contract Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4FQ2 contract is nearly unchanged at US$106.50, keeping the short-term range at US$100-120. The API4 Cal25 contract was three per cent higher at US$114.50. Brannvoll ApS expects a broader range of US$100-150 in 2024 as volatility is higher in API4.

Petcoke

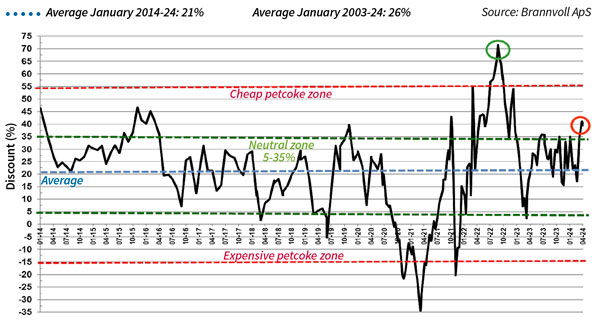

Petcoke, which is seen with very high discounts to coal and near long-term support levels, did turn upwards. The attractive levels have been used by Indian and Turkish end users seen in the market, also based on lower freight rates. The higher demand from India, combined with substitutions for coal from the US being kept back due to the Baltimore bridge accident, enabled sellers to increase prices and buyers to take advantage of the still attractive discounts. Indian demand may fall over the election period in May as several infrastructure projects will await the outcome of elections. Venezuelan selling has been seen lower as the market is nervous regarding the impact of potential sanctions from the US on cargoes under way. The date to watch for Venezuela is 18 April or the election day on 28 July.

Brannvoll reminds that when the petcoke trend turns, it often moves relatively quick both up and down in fear of missing out on cheap levels.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Apr 2024: 40%

The USGC FOB 6.5 per cent sulphur (S) contract rose one per cent MoM to US$68.50, while the discount to API4 rose to 49 per cent. The USGC ARA 6.5 per cent S contract fell one per cent MoM to US$88, but the discount increased to 40 per cent, due to higher ARA coal prices.

The USGC FOB 4.5 per cent S contract also rose 0.5 per cent MoM to US$72.50, with the discount to API4 rising to 46 per cent. The CFR ARA 4.5 per cent contract declined by one per cent MoM to US$92 due to a fall in freight, with the discount increasing to 37 per cent.

Based on the discount the levels still appear attractive with Russian coal and Venezuelan petcoke discounts falling drastically.