By Frank O. Brannvoll, Brannvoll ApS, Denmark

The war premium and geopolitical tensions eased during April and the energy market’s focus has again shifted towards the demand factor in the energy complex. Oil has retraced together with coal and gas.

IMF has adjusted up the expected global GDP growth to 3.2 per cent, but both the US Federal Reserve (Fed) and European Central Bank (ECB) have repeated the mantra “higher for longer” due to developing inflation of above two per cent, especially in the US.

The US has passed a support package for Ukraine, but at the same time as “discussions”, a possible need for peace talks has been reported. This could be a game changer if it materialises over summer.

Neither the Fed, ECB nor the Turkish central bank changed interest rates during April. The euro-US dollar exchange rate is still locked in the range of US$1.06-1.10. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance – 6 May 2024 |

||

|

Brent crude oil (US$/bbl) |

83.30 |

|

|

Coal |

API2 – 3Q24 (US$) |

112.00 |

|

API2 – Cal 2025 (US$) |

112.00 |

|

|

API4 – 3Q24 (US$) |

107.00 |

|

|

API4 – Cal 2025 (US$) |

111.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

72.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

92.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

66.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

86.00 |

Oil

In mid-April Venezuela found itself under reimposed US sanctions on oil products with effect from end-May. The impact has already been seen with a fall of 38 per cent MoM in oil exports, however, there may be possibilities for exemptions on some products.

The oil market saw the geopolitical premium after Iran/Israel exchanged drones fade away and focussed on demand side, which saw a drop particularly in the US. This offset production cuts in Iran and Iraq within the OPEC+ framework. In addition, fewer attacks in the Red Sea calmed the market.

Brent oil has fallen to US$83, the support level of the uptrend channel between US$82-90, after having touched US$92 at the start of April. Brannvoll ApS forecasts a trading range of US$70-100, with an average of US$90 for 2024.

Coal

In mid-April the coal API Q3 (FQ) contract topped at US$125 and declined rapidly following oil and overcoming the effect from the Baltimore bridge accident.

European imports have fallen based on warmer weather and high stocks in ARA.Russia has (again) paused the 5.5 per cent export fee from 1 May until 31 August, again bringing Russian coal at more competitive levels in areas that are not imposing sanctions and putting pressure on the overall coal market.

Colombia has been improving its market share and seen exports increase steadily lately to its former market Turkey. Meanwhile, US export has been falling after the Baltimore accident and massive gas production have put further pressure on coal prices.

The API2 front-quarter (FQ/3Q24) contract fell by 3.5 per cent MoM to US$112, maintaining the short-term range at US$105-120 but the uptrend stalled for the Cal25 contract. Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4 FQ contract rose by two per cent to US$109, still in the short-term range of US$100-120, with no specific news from South Africa.The API4 Cal25 contract fell three per cent to US$111.

Brannvoll ApS expects a broader range of US$100-150 in 2024 as volatility is higher in API4.

Petcoke

Pressured by the lower coal prices, petcoke remained subdued despite very attractive discounts to coal.

The US reimposed sanctions on Venezuela which resulted in a steep decline in exports, and several buyers are awaiting the fall-out. The petcoke market awaits to see if there will be exemptions for petcoke exports, which has had the short-term effect of widening the 4.5 per cent spread to 6.5 per cent, due to the diminishing supply of Venezuelan products.

Indian and Chinese demand has been low due to election time in India and high stocks in China.

Turkish demand is competing with Russian coal but is seen as steady.

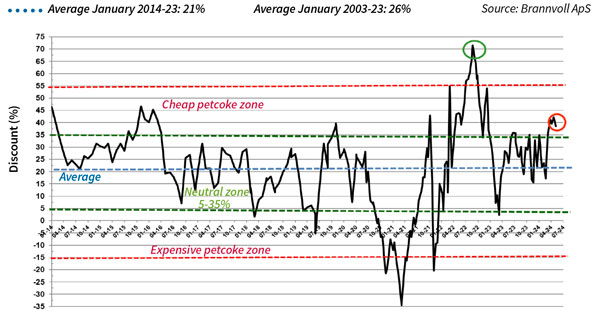

The overall discount levels are still cheap for petcoke and if coal is now close to a major support, the focus in the low- to mid-60s could be to secure supply.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: May 2024: 39%

The USGC FOB 6.5 per cent sulphur (S) contract fell 3.5 per cent MoM to US$66 while the discount to API4 rose to 52 per cent. The USGC ARA 6.5 per cent S contract fell two per cent MoM to US$86, while the discount fell to 39 per cent, due to lower ARA coal prices.

The USGC FOB 4.5 per cent S contract also fell one per cent MoM to US$72, with the discount to API4 rising to 47 per cent. The CFR ARA 4.5 per cent contract was unchanged at US$92 due to a rise in freight, with the discount down to 34 per cent. The 6.5 and 4.5 per cent spread is set to widen as Venezuelan 4.5 per cent S exports are restrained as sanctions are reimposed by the US.