By Frank O. Brannvoll, Brannvoll ApS, Denmark

Geopolitical risk premiums slowly vanished and need new events to return.

Meanwhile, at the start of June, the focus turned towards OPEC and the central banks. The European Central Bank (ECB) delivered its first cut of 0.25 per cent since 2019, giving equities a boost. However, the US Federal Reserve is still seen on hold until at least September. And further cuts from ECB are expected to be ~0.5 per cent more but fully depend on inflation coming towards the two per cent target.

The outcome of the European Parliament election is drawing more attention than usual due to potential changes to the political right and the risk of a lower priority placed on the green transition.

The euro-US dollar exchange rate is still locked in the range of US$1.06-1.10. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

Oil

At its 1 June meeting, OPEC+ decided to prolong its agreement to the end of 2025 but at the same time announced that the current production cuts will be phased out over the next 12 months, including the voluntarily cuts from Saudi Arabia and Russia. This was received negatively by the market and oil plummeted from US$82 to US$73 before recovering back to around US$80.

Unless geopolitical situations impact the price level, this will likely lower the trading range to US$75-95, bearing in mind that US$80 is the preferred range for several OPEC members. The focus will be on demand over the summer and how the demand side develops, especially in China, while the state of the property market can still play a role. Following lower industrial demand in Europe, demand comes mainly from Asia. The gas market saw volatile fluctuations based on rumours of lower Norwegian production, but storage in the EU is high. Brent oil has fallen to US$79, with major support at US$78 and a new short-term range of US$78-85. Brannvoll ApS forecasts a trading range of US$70-100, with an average of US$90 for 2024.

|

Table 1: Prices at a glance - 6 June 2024 |

||

|

Crude oil (US$/bbl) |

79.00 |

|

|

Coal |

API2 – 3Q24 (US$) |

114.50 |

|

API2 – Cal 2025 (US$) |

118.00 |

|

|

API4 – 3Q24 (US$) |

113.00 |

|

|

API4 – Cal 2025 (US$) |

117.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

71.00 |

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

89.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

65.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

83.00 |

|

Coal

Increased demand due to hot weather in India and China set a firm tone for coal. In Europe increased gas prices led to a return of coal in power production. Indian power generation, especially, imported aggressively. Colombian coal was seen fighting for market share in their former import countries, setting prices lower in competition with Russian exports. With oil and gas prices reducing coal also saw a correction downwards.

The API2 front-quarter (FQ/3Q24) contract rose by two per cent MoM to US$112, maintaining the short-term range of US$108-120. The Cal 25 reached the forecast US$130 target but has now retraced to US$117. Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4 FQ contract rose by four per cent to US$113, still in the short-term range of US$100-120, with no specific news from South Africa. The API4 Cal25 contract fell three per cent to US$111. Brannvoll ApS narrows the range to US$100-140 in 2024 as volatility is higher in API4.

Petcoke

The petcoke market seems resilient to the major moves. However, news that China is discussing a sulphur maximum of three per cent has triggered nervousness in several traders, even if any implementation would take a long time and the sectors are not yet defined. India’s election returned a coalition government and this raised some doubts on the start of large new infrastructure projects with the possibility of lower demand in the short term. The US reimposing sanctions on Venezuela resulted in a big fall in exports to Turkey. Nevertheless, petcoke remains the absolutely cheapest alternative to coal, leading to demand in competition with Colombian and reduced Russian coal prices.

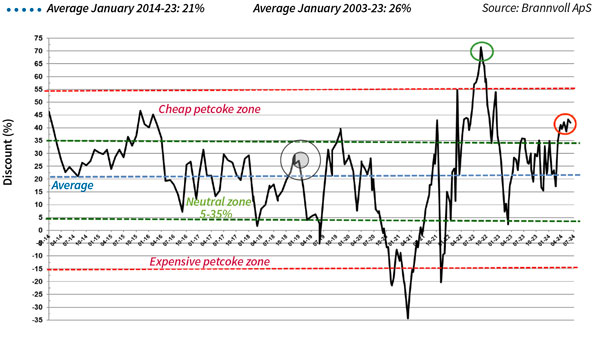

The overall discount levels are still cheap for petcoke, buying in the low-US$60s may be a recommended strategy. The USGC FOB 6.5 per cent sulphur (S) contract fell 1.5 per cent MoM to US$65 while the discount to API4 rose to 55 per cent. The USGC ARA 6.5 per cent S contract fell three per cent MoM to US$83. The discount rose to 42 per cent, due to higher ARA coal prices.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jun 2024: 42%

The USGC FOB 4.5 per cent S contract also fell 1.5 per cent MoM to US$71, while the discount to API4 rose to 50 per cent. The CFR ARA 4.5 per cent contract fell three per cent to US$89 due to a fall in freight, with the discount higher to 38 per cent. The spread between 6.5 per cent and 4.5 per cent is set to widen due to lower Venezuelan exports after US sanctions.