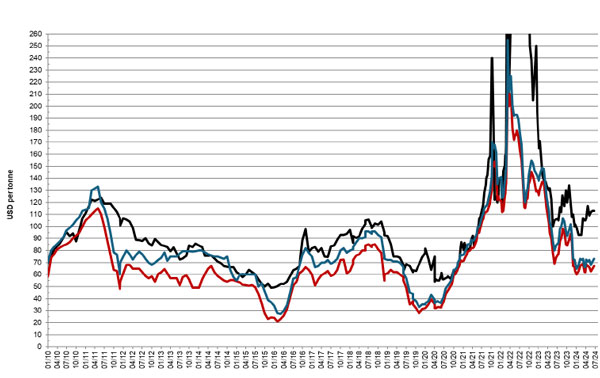

Coal prices moved slightly higher with oil and geopolitics stabilising to surpass the US$110 mark on 21 June 2024. However, the risk is growing with the latest developments in the Israel-Hezbollah conflict.

Petcoke FOB prices pushed higher on demand and coal prices as Venezuelan material. Petcoke discounts decreased slightly and are still in the cheap zone, offering potential.

Coal FOB price trend, January 2010-21 June 2024: API 4 Richards Bay 6000kcal/kg (black), 6.5% sulphur USGC 40HGI (red) and 4.5% sulphur USGC 40HGI (blue)

On 21 June 2024 the discount for 6.5 per cent sulphur petcoke FOB sold at US$67.00 is 53 per cent when compared with API4 coal sold at US$113 in the 3Q24. The CIF ARA 6.5 per cent petcoke contract sold at US$89.00 is at a discount of 43 per cent when compared with API2 coal sold at US$113 in the 3Q24. USGC ARA freight rates are at US$22, up 15 per cent MoM.

Petcoke with 6.5 per cent S is expected to move within the US$60-70 range with resistance at US$68, US$75, US$95, US$105, US$115 and US$135. Support is at US$60, US$55, US$45 and US$38 with multi-year support at US$38. For 2024 a broad range of US$60-115 is forecast.