Geopolitical headlines in November and December dominated the news. The Trump team has been selected and the energy markets are waiting so see if tariffs will be introduced that could set global demand back and spur new inflation, which would reduce chances for further rate cuts. In terms of the war in Ukraine, there appears to be a willingness for peace talks by several sides while the option of a frozen border seems to dominate. The collapse of the Syrian regime further added to uncertainty. Meanwhile, the situation in the Middle East between Israel, Iran, Hezbollah and Hamas appears to be contained after recent events, taking away fear in the oil market. However, the market has been worried about the Chinese economy and its lower demand, but fresh talks of new stimulus packages are seen as positive.

The markets will be “hanging” in ranges until we see real action from the US.

The US dollar has strengthened in the US$ index and against the euro. It is testing the major support of US$1.0500 with a range of US$1.05-1.08 expected. Brannvoll ApS sees a range of US$1.05-1.15, with an average of US$1.12 in 2025.

| PRICES AT A GLANCE - 9 December 2024 | ||

| Brent crude oil – bbl | US$72.00 | |

| Coal API 2 | 1Q25 | US$112.00 |

| Cal 2025 | US$113.00 | |

| Coal API 4 | 1Q25 | US$110.00 |

| Cal 2025 | US$112.00 | |

| Petcoke USGC 4.5 per cent S 40HGI | FOB | US$69.00 |

| CFR ARA | US$88.50 | |

| Petcoke USGC 6.5 per cent S 40HGI | FOB | US$63.00 |

| CFR ARA | US$82.50 | |

Oil

OPEC+ reacted on reports from IEA showing an oil surplus in 2025. Combined with lower prices, this led the organisation to extend the current production cuts by three months. The US and Canada increased their production, adding to the pressure. However, new US sanctions on Venezuela and Iran could reduce supply in the coming months.

In the background a fight for market share could lead to massive falls towards US$50-60 for Brent oil. Brent oil traded lower to US$72, having touched support in its range of US$70-76.

Brannvoll ApS forecasts a trading range of US$65-90 and average of US$75 for 2025.

Coal

The coal market reacted on lower gas prices and a higher US$, forcing the prices sharply down from the top of the expected trading range. There has been good supply from both Colombia and Russia, looking to sell at even lower prices selling with discounts. In addition, new coal has been coming to markets from several suppliers and new mines opening. In Australia anti-coal demonstrations ended and increased the export – all adding to good supply levels.

Meanwhile, demand from India has been weak and in China port owners asked for stocks to be reduced, also dampening demand.

The API2 1Q25 (front-quarter – FQ) contract fell by four per cent MoM to US$112 with a short-term range of US$110-125. The Cal25 contract slipped by five per cent to US$113. Brannvoll forecasts a range of US$100-130 and an average of US$125 for the 1Q25 contract.

The API4 FQ contract fell four per cent to US$110 maintaining the short-term range of US$100-120. The Cal25 contract was again down three per cent to US$112. Brannvoll ApS forecasts a range of US$100-130 in 2025.

Petcoke

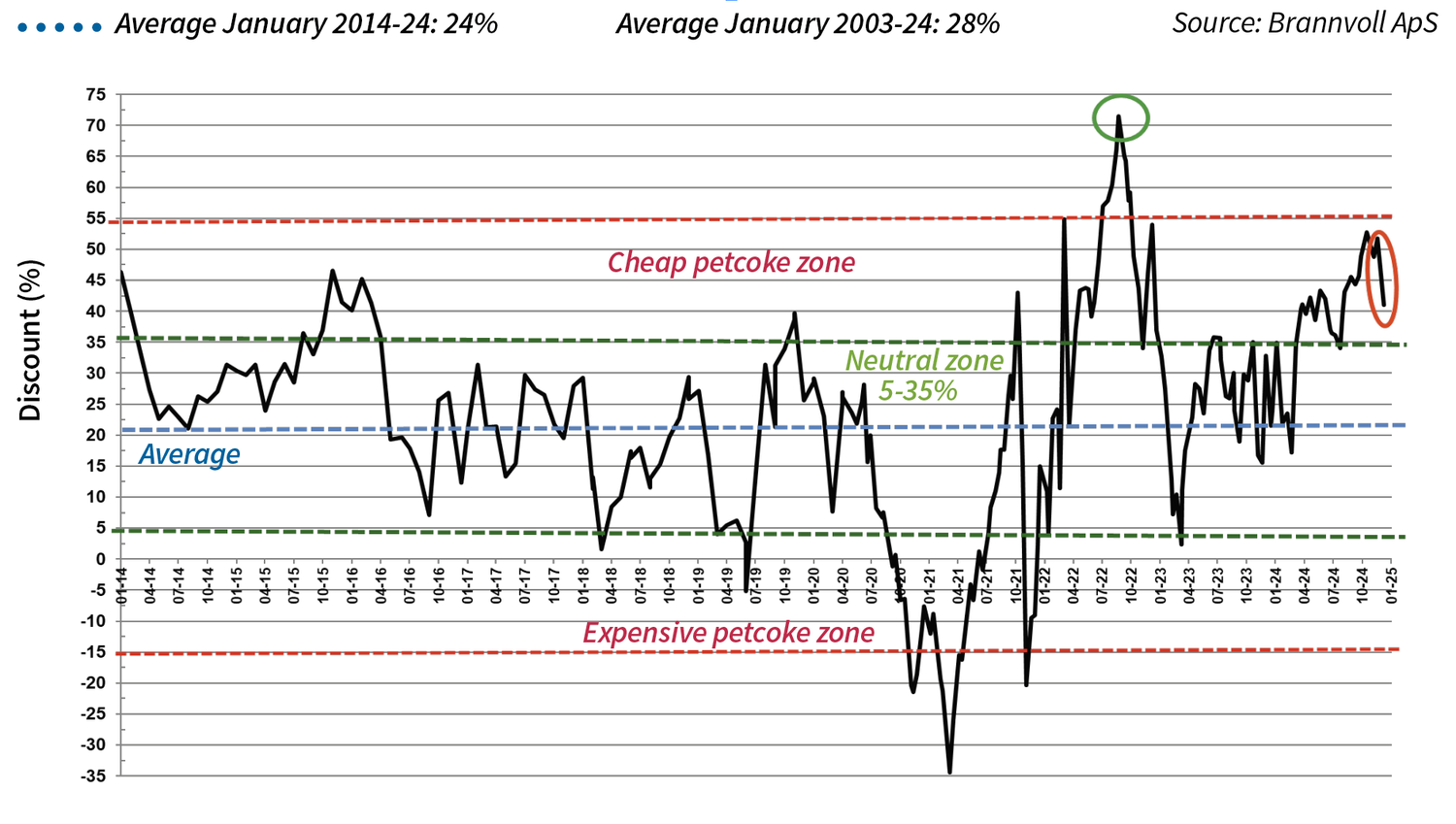

As “warned” in ICR’s previous issue, petcoke prices were turning upwards. The last months have seen a massive move upwards and a fear of missing the low prices has made buyers bid up. Discounts were high, making petcoke absolutely the cheapest choice.

The shadow from a possible Chinese ban on petcoke seems to have vanished because industries such as cement would be allowed to continue burning petcoke. There are no official announcements, but Chinese buyers seem to be back, adding to upward pressure. Several companies have been seen securing petcoke for the early months of 2025.

In terms of petcoke prices, these seem to have bottomed out to just below the US$50.

The price has risen quickly above US$60 and is heading towards high 60s for high sulphur, supported by lower freight rates.

The UGC FOB 6.5 per cent sulphur (S) contract rose sharply by 19 per cent MoM to US$63 and the discount to API4 fell from 62 to 54 per cent. The USGC ARA 6.5 per cent S contract followed with just a 10 per cent increase MoM to US$82.50 due to lower freight rates MoM with the discount stumbling to 41 per cent.

The USGC FOB 4.5 per cent S contract rallied by 17 per cent MoM to US$69, with the FOB discount to API4 falling to 50 per cent. The CFR ARA 4.5 per cent contract rose nine per cent to US$88.50.

The spread between 6.5 and 4.5 per cent S contracts remained at US$6, moving within a US$ 4-8 range.