The first weeks after Trump’s inauguration were hectic. The US withdrawal from the Paris Agreement and promises of increased US oil production could lead to lower the oil prices. The geopolitical situation is volatile with Trump’s rhetoric around the take over of Canada, Panama and Greenland. Meanwhile, there has been a half-hearted start to a tariff-focussed US trade war against Mexico and Canada, but it was later postponed. China and US have exchanged 10-15 per cent tariffs on specific products but not yet on petcoke. In the Middle East, tensions appear to be easing and threats affecting shipping are falling. Rumours are also circulating of an end to the Ukrainian war with a land-for-peace deal.

The CRB commodity index has shown sharp rises over the last month, adding to inflation fears. The European Central Bank has lowered interest rates by 0.25 per cent, but the US Federal Reserve has kept the rate unchanged, citing the need to monitor rising inflation as the reason.

The US dollar has been in a tight range on the broad US$ index against the euro, testing the major support of US$1.03. Brannvoll ApS expects the short-term exchange rate to fall to US$1.02 and in 2025 move within a range of US$1.05-1.15, with an average of US$1.12.

| PRICES AT A GLANCE - 7 February 2025 | ||

| Brent crude oil – bbl | US$74.80 | |

| Coal API 2 | 2Q25 | US$105.00 |

| Cal 2026 | US$115.00 | |

| Coal API 4 | 2Q25 | US$101.00 |

| Cal 2026 | US$110.00 | |

| Petcoke USGC 4.5 per cent S 40HGI | FOB | US$83.00 |

| CFR ARA | US$100.00 | |

| Petcoke USGC 6.5 per cent S 40HGI | FOB | US$78.00 |

| CFR ARA | US$95.00 | |

Oil

Oil fell by a few dollars after Trump’s promise to add more oil to the markets. After the introduction of new US sanctions, which appear to have been respected by India, Turkey and China, Russian exports have been falling. The market is still assessing if demand will be affected by tariffs or if OPEC will engage in a war on market share that could push oil sharply lower. OPEC+ is still expected to defend a price of US$70-90/bbl and a fight for market share could lead to massive falls towards US$50-60 for Brent oil. TTF gas prices were higher as the EU is importing more due to a low storage level.

The closed transit of Russian gas via Ukraine to Slovakia, Czechia and Austria has increased the volume through Turkey and increased LNG imports.

Brent oil traded lower at US$74.50, still trapped in a range of US$72-79. Brannvoll ApS forecasts a trading range of US$65-90 and average of US$75 for 2025.

Coal

The coal market remained within the forecast range as forecast, despite being hit with a 15 per cent tariff from China. US coal has been exempted and other coal markets saw increased demand as European coal consumption expanded due to higher gas prices.

South Africa has increased its exports and Colombia is seeking to advance its market share with lower prices. Trading has been relatively sluggish, but lower freight rates support FOB prices.

The API2 1Q25/front-quarter (FQ) contract fell by two per cent MoM to US$105, within the short-term range of US$105-115. The Cal26 contract was stable, edging up one per cent to US$110. Brannvoll forecasts a range of US$100-130 and an average of US$125 for the FQ contract.

The API4 FQ contract fell two per cent to US$101, maintaining the short-term range of US$100-120. The Cal26 contract was up two per cent to US$110. Brannvoll ApS forecasts a range of US$100-130 in 2025.

Petcoke

The petcoke market rose sharply, driven by the return of Chinese and Indian buyers as well as the discount to coal. January saw lower freight rates, which gave a lift to FOB prices across the range.

Tariffs have not been seen in the petcoke market, which increased coal’s appeal. Furthermore, there are no further clarifications on the potential Chinese ban, which seems to exempt industrial buyers, including the cement sector.

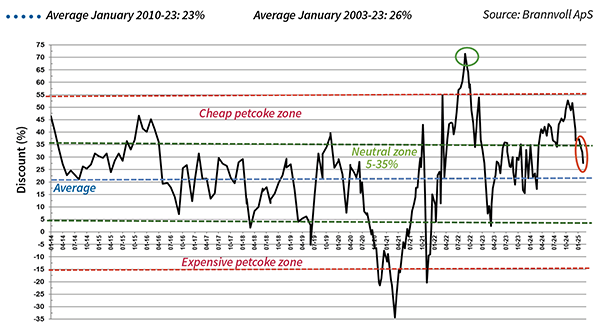

Russian coal sellers, who experienced lower demand, have been seen entering the market with aggressive offers. The petcoke-coal discount is now low in Mediterranean and Chinese markets.

The UGC FOB 6.5 per cent sulphur (S) contract was up by massive 20 per cent MoM to US$78 and the discount to API4 fell from 50 to 38 per cent. The USGC ARA 6.5 per cent S contract rose only 13 per cent MoM to US$ 95 MoM with the discount falling from 37 to 28 per cent due to the fall in freight rates.

The USGC FOB 4.5 per cent S contract rose by 19 per cent MoM to US$83, with the FOB discount to API4 falling to 34 per cent. The CFR ARA 4.5 per cent contract rose 12 per cent to US$100, a price not seen for months, and discount lowered to 25 per cent.

The spread between 6.5 and 4.5 per cent S contracts remained at US$5, moving within a US$4-8 range.

By Frank O. Brannvoll, Brannvoll ApS, Denmark.