Handysize rates cooled in both the Atlantic and Pacific basins. RV Atlantic rates fell from US$15,320/day on 30 May to US$15,000 a fortnight later. The slip in the Pacific market was even more marked as RV Pacific rates fell from US$6230 to US$4900/day over the period. However, the TCT Cont/Far East contract provided some good news as it edged upward from US$19,200 to US$19,600.

After its recent downward trend, the Panamax market bottomed out during the week ended 6 June recording rates of US$7300/day and US$4950/day on the transatlantic and TCT Far East RV routes, respectively. While the subsequent week saw a slow start with Fearnleys reporting a lack of fresh cargoes and a steady flow of ballasters entering the Atlantic, the market improved for shipping companies. Far East RV rates noted an 11 per cent rise and their transatlantic counterparts a 20.5 per cent increase, resulting in day rates of US$8800 and US$5500, respectively. News of China starting up stimulus packages is expected to drive up rates.

The Capesize segment saw limited cargoes and as a result, prices failed to pick up. The TCT Cont/Far East slipped from US$22,000/day to US$19,608/day between 30 May and 13 June. Richards Bay to Rotterdam trips also shaved off around 11 per cent of their cost, falling from US$7.60/t to US$6.72/t over the period.

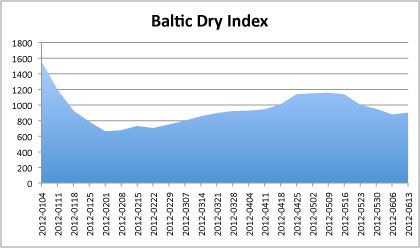

The Baltic Dry Index rose to 902 in the week ended 13 June 2012

Finally, the Baltic Dry Index picked up in the week ended 13 June as it rose to 902 after leveling out at around 878 the previous week.