The USG Supramax spot freight market strengthened overall during the month, despite uncertainty among the market players amid the US government’s various back and forth moves regarding imposing tariffs for imports from China, Canada and Mexico.

Nevertheless, owners were raising their prices to benefit from the market’s positive momentum as more cargoes surfaced. Closer to the end of the month, the market sentiment started coming under pressure as the tonnage supply looked heavy. This mainly affected the fronthaul trades, as charter bids decreased sharply, while owners remained resistant when it came to the transatlantic trades.

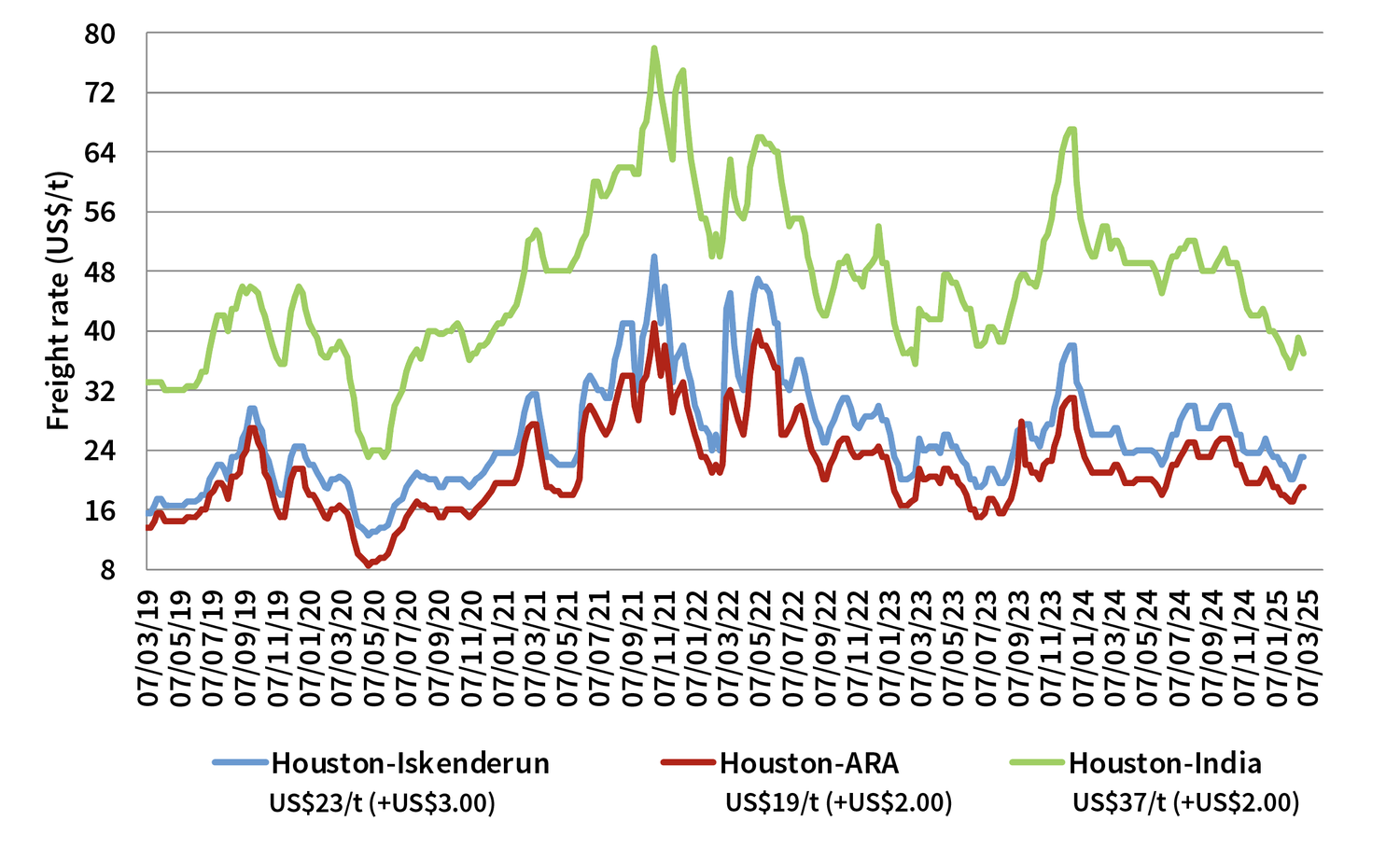

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$19/t on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$23/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$37/t on average.

Overall, more fresh demand will be needed to change the sentiment and allow shipowners to maintain a persistent positive trend in the USG area. Meanwhile, since the South American grain season is gaining momentum, most Chinese buyers will switch to this origin since the US-China relationships are not stable at this point. The lack of grain offers might affect the USG market overall, triggering tonnage surplus issues in the area, which will put considerable pressure on the USG shipping rates.

by Brannvoll ApS, Denmark