The USG Supramax spot freight market had a mixed sentiment throughout December. At the beginning of the month, the segment showed improved activity levels as charterers and owners were eager to fix before the holiday season began. Thus, charterers were actively looking to fix petcoke from USG, metcoke from the north coast of South America (NCSA) and coal from the US East Coast (USEC). Meanwhile, grain volumes remained unimpressive. But as the holiday season approached, the tonnage list grew longer in USG and USEC, while the number of corresponding cargo offers got lower, which caused the rates to fall for all trades.

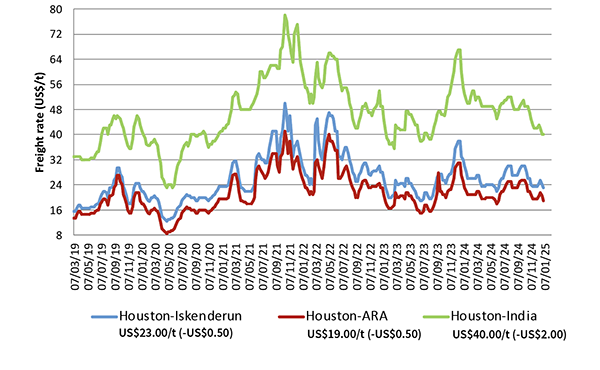

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$19/t on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$23/t on average.

Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$40/t on average.

Trade is likely to remain slow in the Atlantic Ocean. Upon the end of the holidays, freight rates will likely sag, as the list of vessels open for January/February dates will grow in almost all parts of the basin. The main commodity markets offer no preconditions for any cargo traffic upturn. Some players expect that global trade may revive somewhat after Trump’s inauguration.

Still, most traders are very skeptical of this forecast and, on the contrary, fear a worsening of the situation in case of a possible revision of trading and tax regulations between the USA, EU and China.

by Brannvoll ApS, Denmark