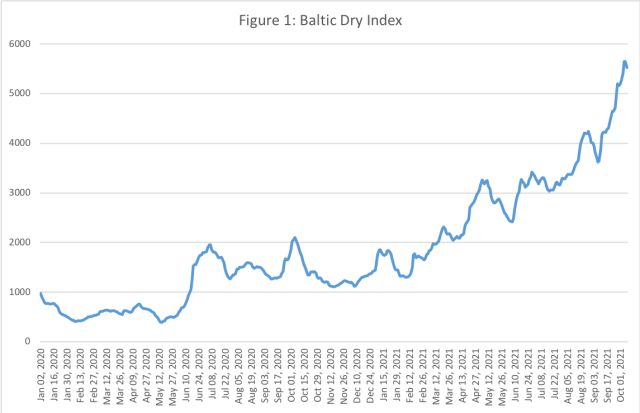

On 7 October 2021, the Baltic Dry Index, a global indicator of bulk freight rates, reached 5670, marking its highest level since September 2008. This compares to just 393 in mid-May 2020 at the height of the pandemic (see Figure 1). The surge in rates can be attributed to a number of causes, primarily the re-opening of economies following COVID-19, which has led to a spike in demand for sea transportation as manufacturing resumes. However, due to the staggered nature of the reopening, vessels have often been in the wrong place to meet demand, causing bottlenecks and port congestion. According to Braemar ACM Shipbroking, almost six per cent of the global dry bulk fleet is currently waiting offshore in China due to the reintroduction of lockdown measures in the country. Soaring fuel costs are also to blame with bunker fuel prices the highest they have been since July 2014, forcing shipowners to raise freight rates.

Figure 1: Baltic Dry Index, January 2020-October 2021

With many cement producers relying on marine transportation, not only for their supplies of input materials and fuel but also exports, the surging freight rates have had a notable impact on both cement prices and trade. One study by the Kenya Association of Manufacturers saw the average cost of imported clinker come in at US$100/t in September 2021, compared to US$47/t for locally-produced clinker. Ocean freight from South Africa to Karachi has also risen from US$11/t in September 2020 to US$30/t in the same month a year later. Elsewhere, Bangladesh saw freight rates to transport clinker from Indonesia, Vietnam and the Middle East in May 2021 increase by up to 30 per cent over just a few months. Many countries are reporting declining cement exports, including Pakistan, where they fell 49.5 per cent YoY in September 2021, and Saudi Arabia where they tumbled almost 45 per cent YoY in July 2021.

Faced with an ongoing squeeze on margins, not only due to rising freight rates but also escalating energy costs, producers have been left with little choice but to raise prices. Iran saw its cement prices rise five-fold in July this year while prices in Turkey advanced by around 56 per cent in the same month. In September, the price of a 50kg bag of cement increased from US$10.50 to US$13 in Zimbabwe, while India saw its cement prices advance by around INR50 (US$0.66)/50kg bag in the opening week of October. Leading players have already responded, including Cemex which will be implementing two price hikes in 2021 as surging input costs continue to put pressure on margins.

With the economies around the world currently competing for a finite supply of coal and China willing to pay any price due to its low stockpiles, dry bulk freight rates are not expected to fall anytime soon.