By Maria Vasyutenko, freight associate of Brannvoll ApS, Denmark

The USG Supramax/Ultramax spot freight market experienced a sharp rate fall after a short-lived spike.

Traditionally, the month started on a positive mode. USG tonnage supply was tight, while there was plenty of cargo due to move prior to the holidays.

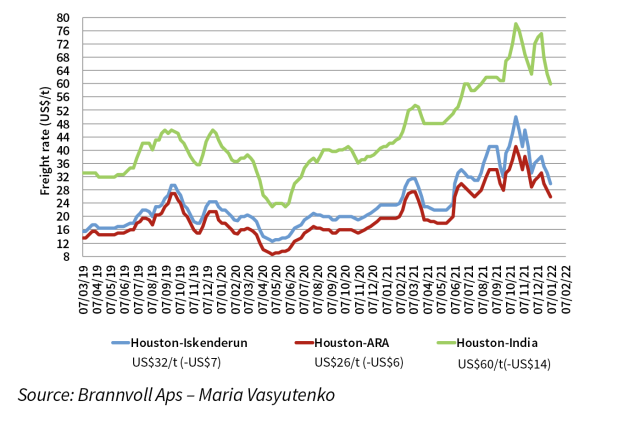

Supramax freight rates for petcoke from Houston, USA

It allowed shipowners to push rates up before a substantial drop. As the month progressed, given the time of year, owners were making more practical than commercial decisions when accepting sharper rates in an effort to clear the decks before the holidays begin.

At the end of the month, the tonnage list was considerably greater than the demand and therefore owners have to discount drastically to secure employment.

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$26/t (-US$6/t MoM) on average.

Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$30/t on average (-US$7/t MoM).

The freight rates on fronthaul directions (trips to southeast Asia and China) showed quite a big drop in rates as the US grain season failed to gain momentum after its delayed start. The pre-holiday spike of activity in the fronthaul segment did not really help the rates to reach expected heights. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$60/t (-US$14/t MoM) on average.

The first quarter of the year is traditionally the slowest period for the dry bulk freight market. Therefore, further rate falls are expected on the back of limited demand from the main importers, slow cargo flow and growing tonnage supply in the Atlantic basin.