The USG Supramax/Ultramax spot freight market had a negative month. Tonnage supply was bigger than the cargo list and ballasting vessels from the European continent only put additional pressure on rates.

With Chinese holidays around the corner, fronthaul cargoes were on hold. Spot vessels were competing in a charterer’s market and rates continued to soften. There was an influx of fresh cargoes for second-half February laycans, but spot rates remained under pressure.

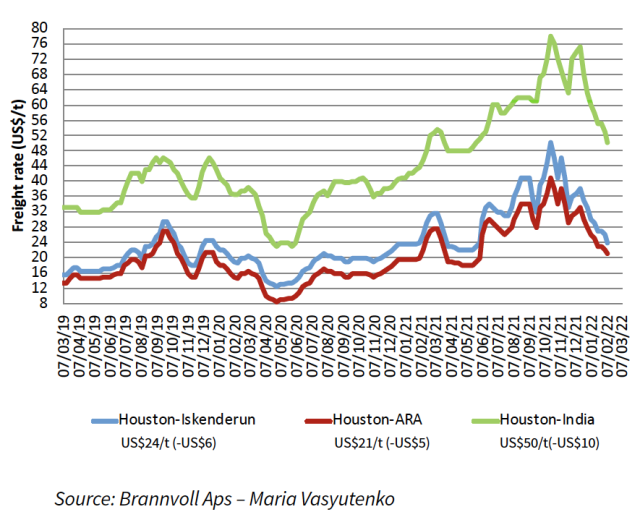

Supramax freight rates for petcoke from Houston, USA

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$21/t (a US$5/t decline MoM) on average.

Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$24-25/t on average, down US$6/t MoM.

The freight rates on fronthaul directions (trips to southeast Asia and China) showed quite a big drop in rates amid slowed import of grains due to the upcoming holidays in China. Shipping costs for the delivery of a Supramax-lot of petcoke from USG to EC India are at US$50/t on average, representing a US$10/t decrease when compared with the previous month.

The first quarter of the year is traditionally the slowest period for the dry bulk freight market.

Most probably the market will stay in negative territory amid limited demand from main importers. Some short-lived spike in rates is expected after China is back from holidays.

Moreover, the situation in the freight forward agreements (FFA) market continues to improve, indicating that players are optimistic about the recovery of the dry bulk freight market closer to the end of the first quarter.