By Maria Vasyutenko, associate of Brannvoll ApS

The USG Supramax/Ultramax spot freight segment experienced a volatile month. At the beginning of the month, transatlantic routes were paying better than fronthaul routes, which was an unusual situation for the market. The reason for these upside-down tendencies was a combination of different factors: the Black Sea area being a risk for owners, uncertainty within the Atlantic basin and a strong Pacific segment. This made owners interested in fronthaul trades so that rates fell below transatlantic levels. However, this anomaly disappeared relatively quickly. In the second half of the month, the wide gap between transatlantic and fronthaul rates started narrowing slowly as the Mediterranean and European continental regions were looking healthier and corresponding rates started picking up. As a result, USG transatlantic rates started dropping very quickly.

Transatlantic rates decline after market volatility

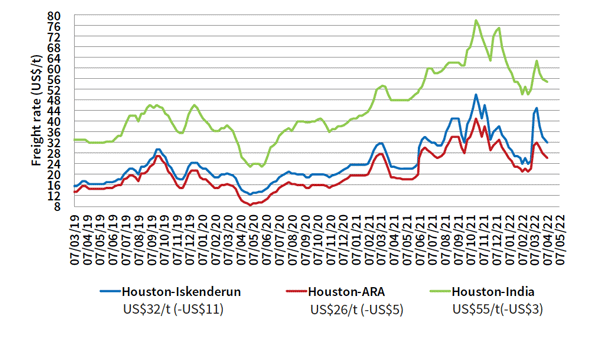

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$26/t (-US5$/t MoM) on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$32/t on average.

Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$55/t on average (-US$3/t MoM).

Overall market sentiment shows signs of optimism for the second half of April and early May with new cargo offers (grains and petcoke) that have begun trickling in the USG for these dates. Transatlantic rates are likely to remain strong since the Mediterranean area will continue to be oversupplied with ships repositioned from the Black Sea.