By Frank O. Brannvoll, Brannvoll ApS, Denmark

New EU oil sanctions against Russia have again moved the energy complex higher, particularly oil and coal, as the EU now has to find new suppliers, leading to increased costs for end users.

Moreover, the inflationary fall-out from the Ukraine-Russia war is now seen in all economies. The US Federal Reserve has turned to sharp rate increases and the European Central Bank (ECB) is now expected to start raising rates up to 125bp for the end of 2022, resulting in uncertainty for the property and equity markets as cheap money goes away.

The euro has gained back after testing US$1.045 and is expected to trade US$1.045-1.08 within the US$1.045-1.15 range. The Turkish lira has again come under pressure due to high inflation figures.

|

Prices at a glance |

|

| Crude oil - bbl | US$121.00 |

| Coal API2 - 3Q22 | US$294.00 |

| - Cal2023 | US$230.00 |

| Coal API4 - 3Q22 | US$293.00 |

| - Cal2023 | US$217.00 |

| Petcoke - USGC 4.5% 40HGI FOB | US$193.00 |

| CFR ARA |

US$228.00 |

| Petcoke - USGC 6.5% 40HGI FOB | US$180.00 |

| CFR ARA | US$215.00 |

Oil and gas

OPEC+ surprised the market by increasing output to 648,000b/d in July-August, which is 200,000b/d more than planned. However, OPEC has been producing about 1.3mb/d below its targets, keeping the market short.This shortfall is mostly based on Russian production, which is reduced due to sanctions. However, Russia is finding new buyers in China and Turkey, based on big discounts.

China returning to the market after COVID-19 lockdowns has also increased demand, pressuring prices above the US$120 mark.

Brent oil is traded at US$121. It is expected to trade between US$110-125, depending on the outcome of peace talks.

Coal

Coal markets followed oil higher, after a fall in May, due to increased imports into the EU before sanctions kick in. For power generation the Clean Dark Spread is still offering best value. Russia keeps exporting via large discounts to Turkey and India while ARA stocks have increased again. India is increasing its coal imports based on high power demand. The market has seen large volatility and wide spreads. China’s post-lockdown return to the market will also increase demand, but the Chinese market is regulated from within and viewed as outside the world market. In addition, Australian Newcastle coal set a new all-time high.

API2 front-quarter (3Q22) contract fell 2.5 per cent MoM to US$293. A range of US$250-330 is expected. API2 Cal23 fell eight per cent MoM to US$230. A range of US$210-250 is predicted.

API4 front-quarter (3Q22) contract eased by one per cent MoM to US$293, with a narrower range of US$270-325 expected. API4 Cal23 fell 5.6 per cent MoM to US$217, with an expected range between US$190-240.

Petcoke

The petcoke market is slightly underpinned by large discounts and overall higher prices. In markets such as Turkey and India, competition from discounted Russian coal is keeping prices down. The Indian cement market been weaker than expected, lowering demand as well. Higher freight prices also keep a lid on the FOB price. In China domestic coal is still being kept artificially low, while petcoke production increased due to higher imports of Russian oil, which generates more petcoke.

Venezuela has restored and renovated a petcoke shipping terminal and is offering large discounts on the 4.5 per cent sulphur (S) product. The country also has millions of tonnes of petcoke of different qualities waiting to be sold. This push to market has narrowed the gap between high- and medium sulphur.

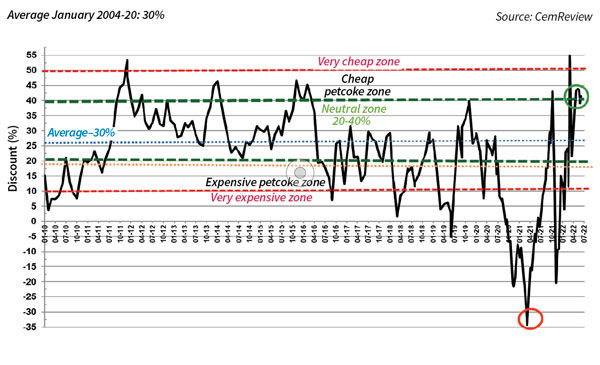

Discounts are currently rising, making petcoke attractive when compared to non-Russian coal. The US utilisation of refinery capacity has risen again to 92.6 per cent, implying more petcoke supply comes out.

The USGC FOB 6.5 per cent S contract is estimated at US$180, up 4.5 per cent MoM from US$172, with the discount to API4 at 51 per cent, still in the cheap petcoke zone. The USGC CFR ARA 6.5 per cent rose one per cent to US$215 due to lower freight costs MoM.

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jun 2022: -41%

For 4.5 per cent S petcoke the USGC FOB is estimated at US$193, up 0.5 per cent MoM from US$192 with the discount to API4 at 42 per cent. The CFR ARA contract is estimated at US$228 with a discount at 38 per cent.

The spread between 4.5 and 6.5 per cent narrowed to US$13 due to Venezuelan sales of 4.5 per cent S product.