By Maria Vasyutenko, associate of Brannvoll ApS

The USG Supramax/Ultramax spot freight market remained under pressure throughout July due to build-up of early tonnage, combined with a shortage of spot cargoes. In addition, a widening gap between the weak Atlantic market and firmer Pacific segment sharpened competition for the limited number of fronthaul opportunities available. Vessels open in NCSA and Caribs chose to fix from northern Brazil rather than from USG. Market participants were holding back waiting to see if the market is experiencing a short-term correction or if this downward trend is there to stay.

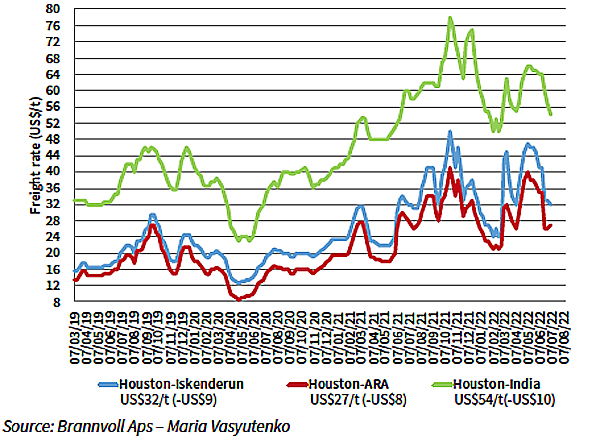

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$27/t (-US$8/t MoM) on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$32/t on average.

Supramax freight rates for petcoke from Houston, USA

Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$54/t on average (-US$10/t MoM).

In terms of outlook the USG market remains under pressure amid excessive tonnage supply and an active influx of ballasters from weak European markets as the Mediterranean area will stay weak and oversupplied with ships repositioned from Black Sea, which also puts pressure on other European freight markets. The weak Panamax market and volatile FFA segment only add to the overall negative sentiment and uncertainty in the USG region.