By Maria Vasyutenko, associate of Brannvoll ApS

The USG Supramax/Ultramax spot freight market started the month in a positive mode, showing recovery with rates firming up amid a shortened list of spot tonnage and a steady cargo flow.

The greatest gains were seen in the transatlantic segment, while the fronthaul market was static by comparison, as the number of owners looking to reposition vessels to the Pacific area is more than covering the number of available orders.

However, during the last week of the month, the market started coming under pressure with charterers revising their rates downwards on the back of slowed demand coupled with a substantial increase in tonnage count. There was a lengthy tonnage list and a good clear-out is required for the market to maintain the current levels.

The fronthaul segment is stagnant, while still better rates are available for trades within the Atlantic to destinations owners still prefer to avoid (eg, the weak Continent and Mediterranean markets)

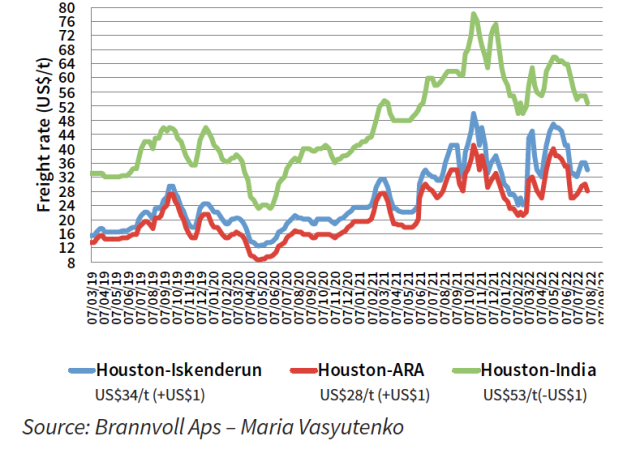

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$28/t (+US$1/t MoM) on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$34/t on average (+US$1/t MoM). Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$53/t on average (-US$1/t MoM).

Supramax freight rates for petcoke from Houston, USA

Supramax/Ultramax owners may face another round of falling rates in Atlantic. The spot tonnage list is growing gradually in both the North and South Atlantic, which will put pressure on corresponding rates. A small short-term upturn in the neighbouring Panamax segment is also unlikely to provide any noticeable support to Supramax/Ultramax owners. Only the transatlantic sector will most probably remain stable as even a possible resumption of grain exports from Ukraine does not particularly motivate owners to reposition fleet to Europe.