By Brannvoll ApS, Denmark

It has been a month of negative corrections in the USG Supramax/Ultramax segment amid a growing tonnage list, as well as an absence of fresh cargo offers for spot laycans. Owners will be expected to accept lower price levels than previously on fronthaul routes. The European continent and Mediterranean basin remain the destinations of last resort for most owners and as a result, rates in that direction fell less significantly.

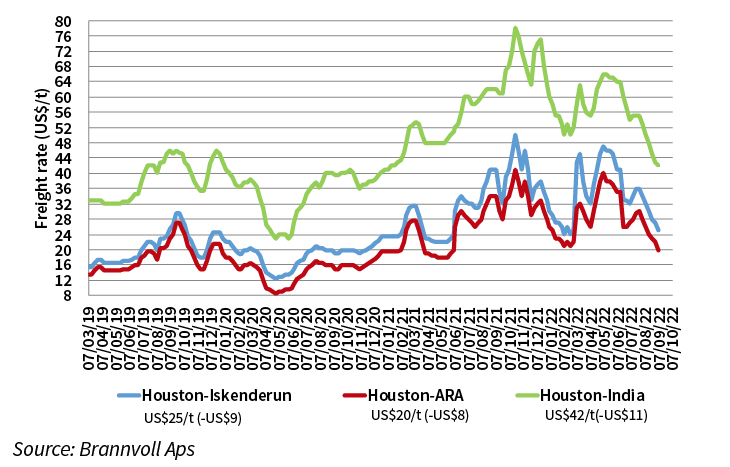

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$20/t (-US8$/t MoM) on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$25/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$42/t on average (-US$11/t MoM).

Supramax freight rates for petcoke from Houston, USA

Supramax/Ultramax market fundamentals are not expected to switch to the owners’ side in the near future. September cargoes are slowly coming up but are quickly absorbed by excessive tonnage supply in the area. For the USG grain season to gain momentum there is a need to wait at least until October. Therefore, deals for October and November shipments are actively discussed, especially on fronthaul routes. Given the fact that the FFA market is subdued now, charterers are interested in concluding forward deals more than work on spot agreements. But at the same time rising forward activity will soon provide some support to the spot market and help, as for a start, to stabilise rates for shipments ex-USG ports.