By Frank O. Brannvoll, Brannvoll ApS, Denmark

The perfect storm has hit European energy end users, as EU sanctions against Russian energy exports are now backfiring in terms of prices and supply security. The EU is currently working on different packages to curb prices, but this will be extremely challenging if a free and market-based price structure is wanted. At the same time, drought and a reduction in nuclear power generation is adding to the severe supply situation as gas prices have soared. The ECB and FED have again raised interest rates by 0.75 per cent and inflation remains high, paving the way for further increases. This in turn limits new construction, reducing the possibility to pass on prices to consumers. When hedges in electricity – gas and coal for 2022 runs out – the new reality will likely see more demand destruction, dampening price pressures.

The US dollar strengthened against the Euro to US$0.98 before coming back to US$1.01 and is now on a lower range of US$0.95- 1.05, as long as the FED is in front of the ECB on rate hikes.

|

Prices at a glance |

|

| Crude oil - bbl | US$92.00 |

| Coal API2 - 4Q22 | US$330.00 |

| - Cal2023 | US$290.00 |

| Coal API4 - 4Q22 | US$325.00 |

| - Cal2023 | US$285.00 |

| Petcoke - USGC 4.5% 40HGI FOB | US$130.00 |

| CFR ARA |

US$150.00 |

| Petcoke - USGC 6.5% 40HGI FOB | US$124.00 |

| CFR ARA | US$144.00 |

Oil and gas

OPEC+ intervened this month as oil fell below US$90 with fear of demand destruction from recession and continued lockdowns in China. Reversing the increase from the previous month, OPEC+ decreased production by 0.1mbd, which only sent a signal. It also underlined that many OPEC countries have a minimum budget level at US$90. G7 is thinking of a price cap on Russian oil and gas, but this will be very difficult to implement.

If successful, an Iran-USA nuclear deal could bring 1.8mbd to the market, but India and China have already said they will not participate. In addition, Russia has said they will not deliver to any country participating.

Industrial power generation is now carried out on diesel back-up generators, increasing the demand for diesel.

The oil price is now seen in a wide range of US$85-115 underpinned by geopolitics, EU sanctions, war and nuclear talks.

Coal

New records in the gas market have driven coal demand even higher in Europe. Supply is now required from South Africa and Colombia. Moreover, logistics issues in export countries combined with low water levels in European rivers are leading to distribution challenges, adding pressure on power prices. In China hydropower generation is low, leading to higher coal demand and resulting in new records in Pacific coal prices. Disruptions due to inclement weather in Australia, persistent rail issues in South Africa and lower water levels in the Rhine have all supported higher coal prices. The ARA ports are at an historical high as Europe turns to coal.

The API2 front-quarter (4Q22) contract slipped two per cent MoM to US$330 with a higher range of US$300-375 expected. The API2 Cal23 contract was up five per cent MoM at US$290, pushing the forecast range to US$275-325 with very volatile prices.

The API4 front-quarter (4Q22) contract rose four per cent MoM to US$325, keeping within a range of US$290-350. The API4 Cal23 contract rose 13 per cent MoM to US$285, with a new higher forecast US$295-340 range.

All the forecasts may be disrupted by political intervention set up in September. The market is also seeing financial pressure on margin calls.

Petcoke

Due to a petcoke market meeting in the USA, trading was subdued. However, it seems the collapse in petcoke has stabilised as the discounts to coal and even Russian discounted coal is attracting buyers in India. In Europe buyers are still reluctant as many have stocks and are facing potentially lower cement demand in 2023, as well as very difficult forecasting conditions due to the political turmoil. There have also been some disruptions in the Gulf refineries, giving some support to FOB prices in combination with falling freight rates. Turkey is still reluctant and has seen imports from Venezuela, keeping pressure on prices. Venezuelan exports still put pressure on the medium-sulphur market and the gap between high- and medium-sulphur is reduced to US$6.

The market is still a buyers’ market but coming into the hurricane season with huge discounts some stability could be seen within relatively calmer trading ranges. With gas and coal still higher this adds support.

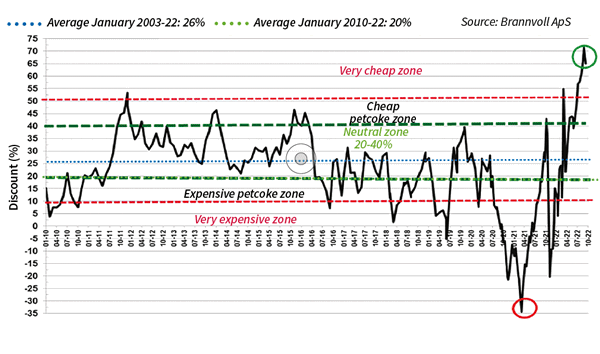

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Sep 2022: 60%

The USGC FOB 6.5 per cent S contract is estimated at US$124, down 10 per cent MoM, with the discount to API4 increased to 69 per cent. The USGC CFR ARA 6.5 per cent contract fell further by 14 per cent MoM to US$144 due to lower FOB and freight, setting a new all-time high discount at 65 per cent.

The USGC FOB 4.5 per cent S contract is estimated at US$130, down 12 per cent MoM, the discount to API4 at 68 per cent. The CFR ARA 4.5 per cent contract fell 14 per cent to US$150 with the discount at an all-time high of 64 per cent.