The USG Supramax/Ultramax market is in a positive mode. Excessive tonnage supply was absorbed fast as demand was gradually appearing, particularly on fronthaul routes. Charterers had to improve their bids as owners started showing resistance.

Consistently strong fronthaul demand and a lack of spot tonnage supply meant rates continued to move upwards.

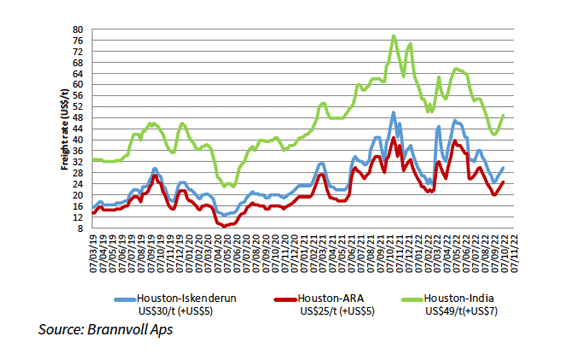

Supramax freight rates for petcoke from Houston, USA

Average freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$25/t, up US$5/t when compared with the previous month.

Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$30/t on average.

Average shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$49/t, up US$7/t MoM.

The Supramax/Ultramax market will likely be gradually shifting to the shipowners’ side as the expected gradual increase in the grain offer ex-USG will positively impact transportation costs in the region.

Additional support for the Supramax/Ultramax segment will come from the strengthening Panamax market in the North and South Atlantic. Note that US exporters are in tough competition with South American exporters (due to heavy grains crop in Brazil). This explains the delayed and rather slow start of the US grain season, which is usually the main driver of the USG market at this time of year.