By Brannvoll ApS, Denmark

USG Supramax freight market sentiment throughout the month was about negative undertones due to a somewhat thinner cargo book. Rates for shipments from the region were softening with more tonnage entering the market and owners having to chase bids and discount if they want to cover. Demand levels were below average for the time of year, mainly due to the ongoing logistic issues in the Mississippi River, where low draught issues complicate barge traffic and slow down grains and fertiliser export. USG area fixing activity was below average with significantly fewer additional requirements that caused ships to pile up daily.

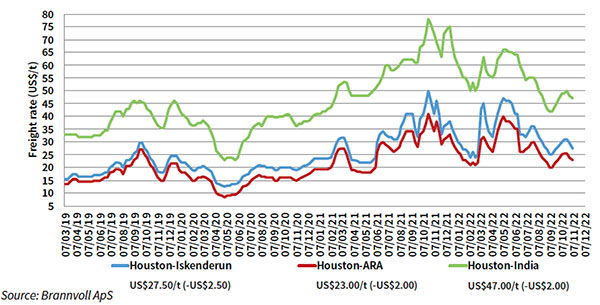

Supramax freight rates for petcoke from Houston, USA

Freight rates for the transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$23/t (-US$2/t MoM) on average. Deals for the delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$27-28/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$47/t on average (-US$2/t MoM).

The Supramax/Ultramax market is expected stay under pressure in the near future due to ongoing issues on the Mississippi River, which negatively affects export levels from the region. Additional pressure will come from softening Panamax markets in the North and South Atlantic.