By Brannvoll ApS, Denmark

The USG Supramax freight market went through ups and downs in December. In the first half of the month, the USG segment showed a steady flow of fresh enquiries. Owners started to raise their offers in response to an abundance of fronthaul petcoke cargoes combined with a decent volume of grains. Closer to the end of the month, sentiment started changing: activity levels decreased with minimal vessels left open for the rest of the month, while all the cargoes were covered. Owners were losing ground and could not keep the rates at peak levels. There was additional pressure from growing tonnage supply for spot dates.

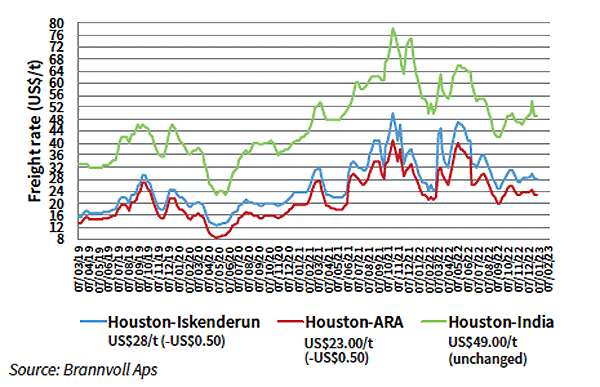

After multidirectional correction throughout the month, freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans ended up at US$23/t (-US$0.5/t MoM) on average. Deals for the delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at ~US$28/t on average. Shipping costs for the delivery of a Supramax-lot of petcoke from USG to EC India are stable at US$49/t on average.

Supramax freight rates for petcoke from Houston, USA

The USG Supramax/Ultramax market is expected to recover its activity after a long holiday season and the main players expect rates to rise again as more cargoes are entering the market for the second-half of January delivery dates.