By Brannvoll ApS, Denmark

The USG Supramax freight market was in free-fall throughout January amid a severe lack of new cargo offers for spot delivery dates. Despite the gradual return of Asia-based chartering managers from their Lunar New Year holidays, the USG Supramax segment kept weakening as reduced tonnage supply in the region put pressure on shipowners. Therefore, owners continued to drop their offers. However, charterers’ bids were even lower day by day and as a result, rates saw a sharp drop.

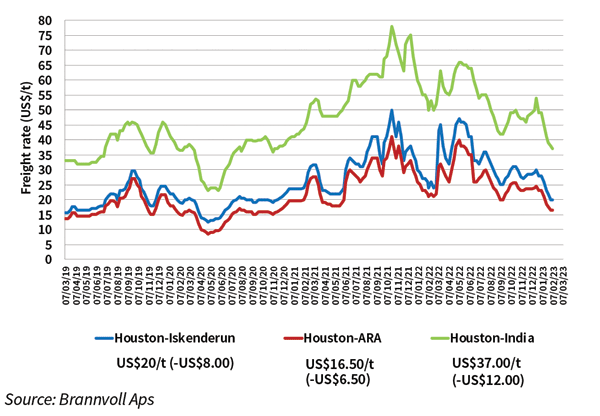

Supramax freight rates for petcoke from Houston, USA

In terms of freight rates, prices for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$16.50/t (-US$6.50/t MoM) on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$20/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$37/t on average (-US$12/t MoM).

The USG Supramax market is expected to pick up in the near future. Market participants report improved demand for the second half of February laycans with more grains and petcoke cargoes entering the market.

In addition, some unambiguous gains being reported in the Panamax segment might be the light at the end of the tunnel, the sign that a bottom has been reached and that the imminent South American grain exporting season may be coming to the rescue for the Atlantic Supramax spot dry bulk freight market.