By Brannvoll ApS, Denmark

The first half of the month looked inspiring for shipowners. The USG Supramax spot freight market improved with rates showing considerable spikes. Demand was healthy, especially for fronthaul trips, due to tonnage being tight for spot laycan dates and fronthaul.

But in the second half of the month the market was already pausing for breath after a rate spike and tonnage supply started to build while demand remained flat. Eventually, the rates decreased amid a demand supply imbalance in the region.

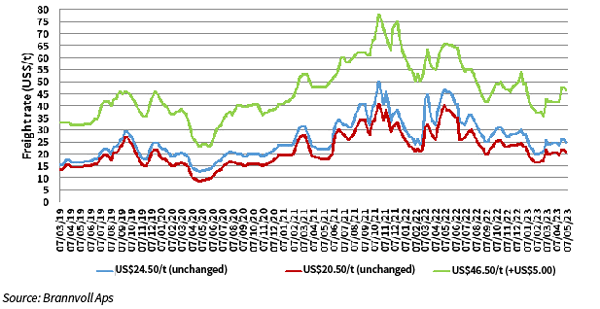

After multidirectional correction throughout the month, rates for ex-USG shipments have stabilised at the levels of the prior month on transatlantic routes. Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$20.50/t on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$24.50/t on average.

Supramax freight rates for petcoke from Houston, USA

Meanwhile, fronthaul rates managed to end up at higher than prior-month levels despite negative corrections observed in the second half of April. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$46.50/t on average (+US$5/t MoM).

The outlook is optimistic amid a tonnage clear-out and healthy levels of demand for May dates, which will help the market to find some support. Furthermore, since a ECSA positive trend is expected as the grain export season reaches its peak, the USG region will benefit from it as well.