By Brannvoll ApS, Denmark

USG Supramax spot freight market activity was limited with rates continuing to slide. Fresh cargo replenishment was slow, resulting in charterers lowering their bids on fronthaul and transatlantic routes. There were a few petcoke requirements towards India and the Far East, but the market suffered from a notable lack of grain cargoes.

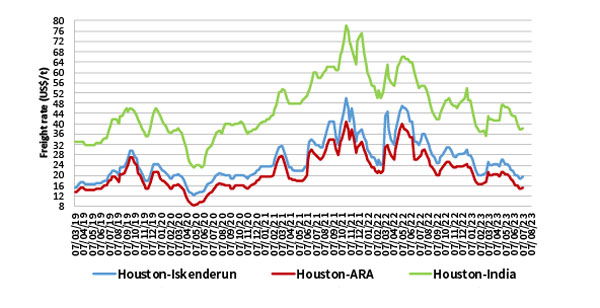

Figure 3: Supramax freight rates for petcoke from Houston, USA, March 2019-August 2023 (Source: Brannvoll Aps)

Freight rates for the transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$15.50/t on average, down US$2.50 MoM.

Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$19.50/t on average. This represents a decline of US$2.50 when compared with the previous month.

Shipping costs for the delivery of a Supramax-lot of petcoke from USG to EC India are at US$38.50/t on average – a drop of US$4.50/t MoM.

In the USG, rates are likely to sag further, as the cargo/tonnage ratio will remain imbalanced soon. Charterers are bidding low for forward cargoes, which does not add optimism to owners. The market needs a significant increase in demand to change the negative trend, while any noticeable spike in export activity is not forecast for the near future.