By Brannvoll ApS, Denmark

The USG Supramax spot freight market started the month on a strong note. Rates were rising across all routes as a region was supported, especially on fronthaul directions, which were dominated by petcoke trades. However, in the second half of the month, rates started slipping below the previous levels due to limited fresh demand, while tonnage continued to pile up for spot/prompt laycan dates. Therefore, the hope for market recovery did not materialise in July.

After bi-directional correction, rates for shipments from the USG ports settled at the levels they ended one month ago.

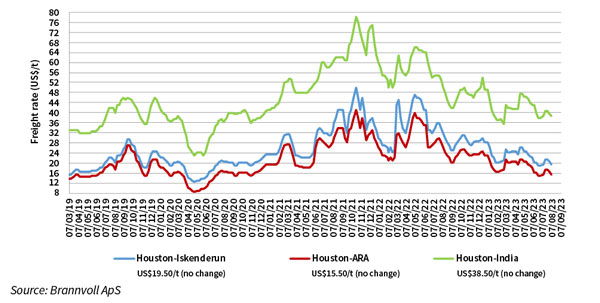

Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at ~US$19.50/t on average. Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$15.50/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$38.50/t on average.

Supramax freight rates for petcoke from Houston, USA, March 2019-September 2023

In the USG the market will almost certainly weaken further, with owners hoping only for brisker petcoke exports. Hopefully, August will bring the inflow of cargoes as the market needs to break this downward trend. Nevertheless, the overall sentiment is soft going forward as there are few preconditions for further growth in the North Atlantic.

The US continues to lose its share of the grain market, as demand for US grains, the key USG market driver from September (when the grain season starts), from major importers is declining.