By Brannvoll ApS, Denmark

The USG Supramax spot market remained strong throughout the month. Freight rates were rising on all routes as fresh demand was at healthy levels, especially on front-haul routes.

The increase in front-haul rates was also partially aided by improved activity on transatlantic routes. Shipowners were increasing their prices on front-haul directions to maintain the rate difference by staying within the Atlantic and performing transatlantic shipments.

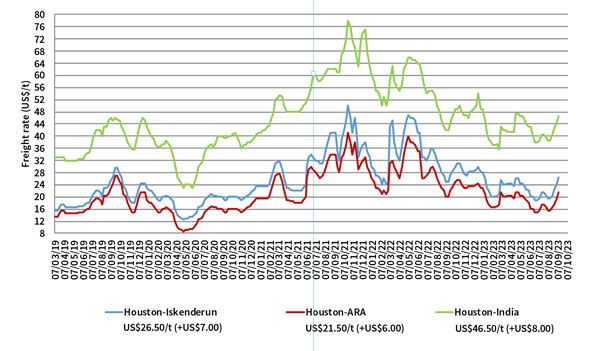

As shown in Figure 1, freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$21.50/t on average. Meanwhile, deals for the delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US$26.50/t on average. Shipping costs for the delivery of a Supramax-lot of petcoke from USG to EC India are at US$46.50/t on average.

Figure 1: Supramax freight rates for petcoke from Houston, USA

The outlook is largely positive for the USG Supramax owners. The US grain season is about to start and slowly gain pace, which means that rates might edge up further as fresh grain orders enter the market.

Nevertheless, a considerable influx of cargo offers is required for current rates to be maintained as tonnage lists grow really fast with a lot of vessels moving in ballast towards USG from less profitable regions, with a hope to catch a really hot market once the grain season comes into force.