By Brannvoll ApS, Denmark

It was a positive start to the month for Supramax shipowners in the USG region. The rates were increasing on fronthaul routes on the back of the tight tonnage supply for prompt dates in the area. Meanwhile, the transatlantic segment looked quiet, and rates were flat. In the middle of the month, the market started being in stand-off. Quite a few fresh cargoes were accompanied by an even greater influx of new vessels. Charterers were happy to wait and see if the tonnage list continued to grow, while owners were not in a rush to step back on their ideas and sign the deals. The month closed on a negative mode as the USG market appeared to build a soft trend as the tonnage list was increasing, while a cargo supply was limited and unable to keep up with the vessel count on the fronthaul routes. Meanwhile, the transatlantic rates stayed largely unchanged throughout the month.

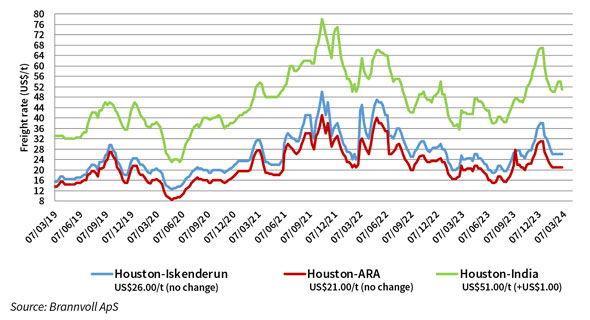

Supramax freight rates for petcoke from Houston, USA, March 2019-March 2024

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$21/t on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at around US $26/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$51/t on average.

The general sentiment is negative looking forward unless a surplus of new cargo orders becomes available soon. There is a need to see a more balanced spread between cargo vs tonnage for any improvement in levels in the short term.