By Frank O. Brannvoll, Brannvoll ApS, Denmark

The euro tested the lower range but remains bound between US$1.17-1.20. Focus on signs of change in the Fed or ECB’s interest policies.

|

Table 1: Prices at a glance |

||

|

Crude oil (US$/bbl) |

72.50 |

|

|

Coal |

API2 – 4Q21 (US$) |

163.00 |

|

API2 – Cal 2022 (US$) |

124.00 |

|

|

API4 – 4Q21 (US$) |

156.00 |

|

|

API4 – Cal 2022 (US$) |

130.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

124.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

158.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

116.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

158.00 |

Crude oil

No real news in the oil market, but OPEC+ is monitoring the market for impacts by the reopening or lockdown of economies, as feared by the market due to the pandemic.

Refineries are seeing increased demand for jet fuel as flights are increasing. Hurricane Ida shut down 75 per cent of the US Gulf refineries, resulting in a supply shortage supporting the market. In its December 2021 meeting OPEC will assess market developments and the organisation’s need for changes to the current deal. Brent has traded between US$65-73 on sporadic news.

The price of Brent oil rose five per cent to US$72.50 from US$69, with resistance at US$73 and US$76. Support is at US$70 and US$67, with a break here potentially leading to US$63. A trading range of US$67-74 is forecast as no major events are expected. Brannvoll retains its forecast to an average of US$65 in 2021 within a range of US$55-80.

Coal

The rally in coal continued, driven by increased demand as gas prices increased, making coal the preferred fuel for power generation. Despite curbs from NDRC, Chinese domestic prices had reached all-time highs of CNY1100 (US$171). Europe has also been increasing import and the API2 has surpassed API4. Overall demand is increasing with supply distorted in several producer countries. Colombian coal exports are falling, while Russian production increased demanding higher prices as reflected in the ARA price rally.

With investment in new coal mines increasingly difficult and fewer new mines brought online, there are reports of prices potentially reaching US$200 by next year. These predictions also serve as a warning that a top may be reached.

While all coal markets are overbought, no real sell signals currently exist.

The API2 front-quarter (4Q21) contract rallied a massive 24 per cent to US$163, back to 2009 levels breaking major resistance at US$150. Resistance is currently at US$165 and US$170, with the next high of US$200 (cf 2009) in sight. Support is found at US$150 and US$130. A range of US$150-170 is expected with high volatility. The API2 Cal22 contract rallied 24 per cent higher at US$124 as well with resistance at US$133 and US$140. Support is at US$110 and US$88 broken out of uptrend. A trading range of US$115-135 is expected.

The API4 4Q21 rallied “only” 15 per cent to US$156. Resistance is found at US$160 and major US$175, while support reached US$140 and US$125. The expected range is US$140-165. The API4 Cal22 contract rallied 22 per cent to US$130, close to major resistance at US$130 and the technical target of US$135, if broken up to US$150-160. Support is seen at US$120 and US$110. Expected range is US$120-140.

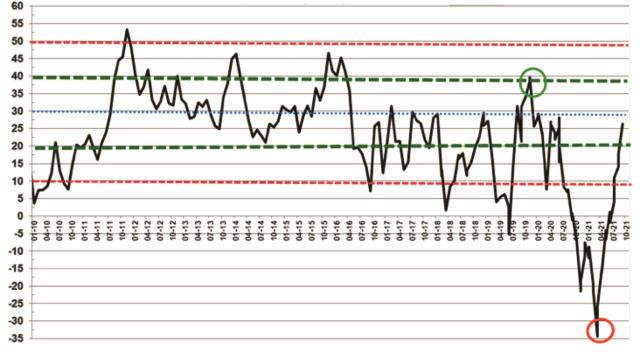

Petcoke

Petcoke could not follow coal upwards, so discounts have widened, making the petcoke even more in demand, dragged by coal.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Oct 2021: 26%

With many US Gulf refineries shut down, lack of power and closed rivers impacting supply, which once again will fall below demand. Turkey, especially, has been looking for increased demand reflected in the price of medium petcoke market.

The rally in petcoke is now above 2009 prices and several calls for a top have been crushed by the coal and gas rallies reflected in the energy complex. Some buyers are now securing on short-term deals as the alternative, coal, is running away.

Freight rates have increased 10-15 per cent and is putting a lid on the FOB price. Refineries are now seeing increased demand for jet fuel, but the weather has an even larger impact. Latin America is seen increasing purchases, fuelling the long-term rally and with high coal prices predicted, making for insecure forecasts.

Proxy coal hedging of petcoke has proven a perfect hedge.

Discounts continued higher on both FOB and ARA contracts due to the coal rally. The USGC FOB 6.5 per cent sulphur (S) contract rose four per cent to US$116, with the discount to API4 at 41 per cent. A short-term range of US$110-120 is expected, with a very real risk of US$120. The ARA contract price equally rose six per cent to US$150 and increased its discount to API2 to 26 per cent as API2 rallied 24 per cent. The USGC FOB 4.5 per cent contract rose six per cent to US$124, representing a 36 per cent FOB discount. It is forecast to trade between US$115-130. The ARA rate of US$158 is again up seven per cent, now offering a real discount of 22 per cent.

The spread between 4.5 and 6.5 per cent petcoke widened above the normal US$4-6 to US$8 and is currently at US$5-10.