Since ICR’s most recent energy report, Russia’s invasion of Ukraine sent shocks into the energy complex. While oil revisited its all-time high of US$140, it has since fallen to US$115/bbl.

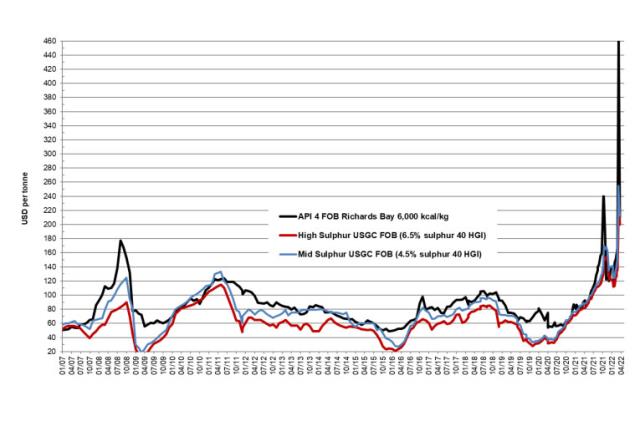

High-sulphur (6.5%, 40HGI) FOB petcoke price, historical view 2006-22 –

Expected range US$175-225. Resistance at US$205, 235 and 250

while support to be found at US$175, 155, 115 and 100. Multi-year support.

Meanwhile, coal was driven sharply higher on supply fears from Russia with all-time highs seen at US$470/t but then dropping rapidly.

In a thin market with limited trading the price of petcoke has surged to US$250/t. Credit risks plays a major role.

As a result of the movements in coal and petcoke prices, the discount is at 60 per cent, now back in the neutral zone. The discount for petcoke (6.5 per cent sulphur) FOB sold at US$200 (compared with API4 2Q22 coal at US$210), is 24 per cent, down from 36 per cent. The discount for petcoke (6.5 per cent sulphur) CIF ARA sold at US$230 (compared with API2 2Q22 coal at US$235), is 22 per cent, down from 23 per cent.

Steam coal and petcoke FOB prices - historical view 2007-22