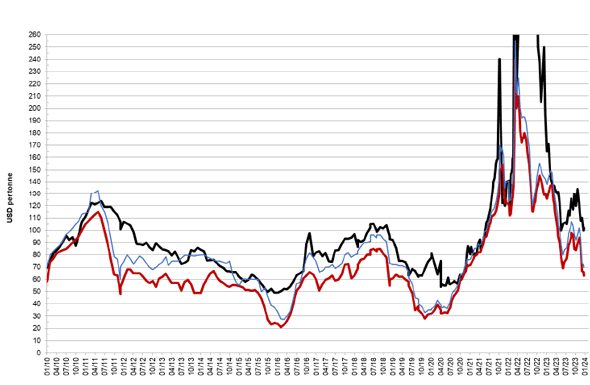

Coal, along with oil fell to US$100 on 21 December 2023, and OPEC+ introduced new cuts to support oil at US$75-80. However, oil rose due to naval attacks in the Red Sea and trouble in the Suez Canal.

Petcoke FOB contracts collapsed as freight rallied making CFR prices expensive.There was also a lack of interest from far destinations. The discount on FOB contracts increased but fell on ARA contracts.

Petcoke discount falls (21 December 2023)

Petcoke with 6.5 per cent S is expected to continue in the US$60-75 range with resistance at US$68, US$80, US$95, US$105, US$115 and US$135. Support is at US$63, US55 and US$45 with multi-year support at US$37. For 2024 a broad range of US$70-115 is expected.

The discount for 6.5 per cent S petcoke FOB sold at US$63 is at 51 per cent when compared with API4 coal sold at US$102 in the 1Q24. The CIF ARA 6.5 per cent S petcoke contract sold at US$99 is at a discount of 22 per cent, when compared with API2 coal sold at US$104 in the 1Q24.

Freight rates are increasing with the USGC-ARA rate at US$36.