By Frank O. Brannvoll, Brannvoll ApS, Denmark

Political risk and central banks were key in energy developments in the June-start of July period. The European Central Bank (ECB) and US Federal Reserve (Fed) both restated that interest rate cuts depend on the inflation rate nearing two per cent. The ECB hinted at two more rate cuts and the FED at possibly one.

The centre-left election results in the UK and France, along with the European Parliament election results, calmed the market after fears of extreme right gains. Meanwhile, in the USA the first TV debate led to further discussions about President Biden’s candidacy in the upcoming presidential elections and whether a new Democratic nominee would be advisable.

The euro weakened to US$1.0650 at first due to uncertainty but has recovered to its range of US$1.06-1.10. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance - 8 July 2024 |

||

|

Crude oil (US$/bbl) |

86.00 |

|

|

Coal |

API2 – 3Q24 (US$) |

106.50 |

|

API2 – Cal 2025 (US$) |

114.00 |

|

|

API4 – 3Q24 (US$) |

107.00 |

|

|

API4 – Cal 2025 (US$) |

113.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

70.00 |

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

92.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

63.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

85.00 |

|

Oil

Geopolitics saw the tension between Israel and Hezbollah flare up, which supported Brent oil. In addition, lower US crude, petrol and diesel inventories, and hope in the markets that central banks will start cutting rates set a bullish tone. At the start of July Hurricanes also approached the US Gulf, adding support for oil prices.

The market has started to view the coming year as being short and thus the increases from OPEC+ will not be adding downward pressure. Furthermore, Venezuela has kept its oil production high despite US sanctions as several buyers are defiant of sanctions.

Brent oil has risen nine per cent to US$86, with major support at US$80 and a new short-term range of US$ 80-88.

Brannvoll ApS maintains a trading range of US$70-100, with an average of US$90 for 2024.

Coal

Lower demand and good supply put a negative mood in the coal market. European demand was low due to lower gas prices, and Colombian sellers were competing in Turkey with discounted Russian coal, putting further pressure on prices. Due to the rainy season, Indian and Chinese demand were seen lower, which more than offset the decrease in production from Indonesia. 2023 was seen as a record year for coal, which reached its highest levels since 2028. Russia, Australia and Indonesia were responsible for 70 per cent of exports in 2023. Meanwhile, South Africa was again disrupted due to poor railway performance. China lowered its import due to big stocks in its ports and less demand.

The API2 front-quarter (FQ/3Q24) contract fell by five per cent MoM to US$106.50, with a new short-term range of US$100-115. The Cal 25 contract fell by 2.5 per cent to US$114. Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4 FQ contract fell by five per cent to US$107, still in the short-term range of US$100-120, with no specific news from South Africa. The API4 Cal25 contract rose two per cent to US$113. Brannvoll ApS forecasts the range to US$100-135 in 2024 as volatility is higher in API4.

Petcoke

The petcoke market was seen lower, due to higher freight prices as well as low demand from India, China and Turkey. China’s decarbonisation plan of banning on high sulphur (>3 per cent) petcoke could lead to a considerable shift in demand and impact global pricing in the medium term if Chinese demand collapses totally. The high-sulphur market has seen few trades with a wide-ranging prices of US$62-68 FOB.

In Turkey cement makers were seen in the market after the holidays in June, and petcoke pricing was in sharp competition with Russian and Colombian coal.

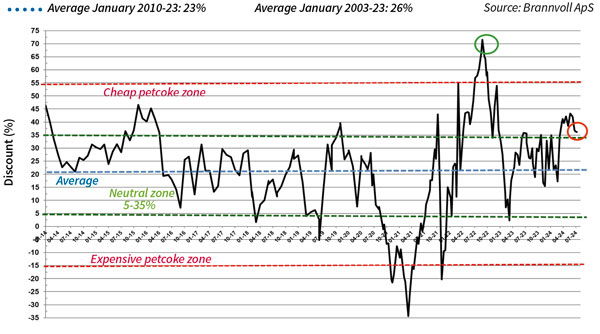

Petcoke still offers a good discount but now in the low range of the cheap zone. The USGC FOB 6.5 per cent sulphur (S) contract fell three per cent MoM to US$63 and the discount to API4 was lower at 53 per cent. The USGC ARA 6.5 per cent S contract rose three per cent MoM to US$85. The discount was down to 36 per cent, due to higher ARA freight and lower coal.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jul 2023: 36%

The USGC FOB 4.5 per cent S contract slipped 1.5 per cent MoM to US$70, with the discount to API4 falling to 48 per cent. The CFR ARA 4.5 per cent contract rose three per cent to US$89 due to a higher freight with the discount lowered to 31 per cent.

The spread between 6.5 and 4.5 per cent S contracts is steady at around US$6-8 due to lower Venezuelan exports after US sanctions.